Swing Trading Strategy:

Another one-day rally?

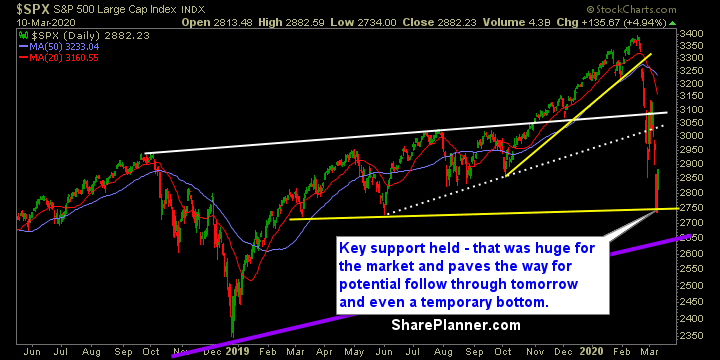

Shaken out early on with my positions I carried over from yesterday, but managed to quickly jump back in like a chicken with his head cut off and capture the profits in those positions – so I am happy about that. What tipped me off was the shakeout early on that saw yesterday’s lows retested, but the sellers were out of juice. They couldn’t create enough selling power to overcome the buyers who were ready to finally buy the dip. That is a good sign for the market and it happened off of key support and the March 2019 lows. All strong positives.

Does it last into tomorrow though?

That is the big question everyone is asking today. There hasn’t been a 2-day rally in the market in over a month – yes a month – not since February 11th. The market is due for a huge bounce, the T2108 has been signaling it for three days, and it reached below 2018 December lows, and just a little above the 2008 lows. Yes, that is a strong buy signal worth respecting. That doesn’t mean that the market won’t eventually retest today’s lows, but it should manage to rally enough to put the fear of God into shorts.

And don’t forget, Wall Street loves tax cuts, that’s why they are being floated around, because more money in the pockets of consumers eventually finds its way into the pockets of companies and that ultimately increases earnings.

Indicators

- Volatility Index (VIX) – Despite the craziness of the VIX of recent weeks, it didn’t lose much ground, falling 13% down to 47.30. Plenty of room to fall, and at some point, we should see that. Some divergences in Stochastics and RSI that suggests a lower reading should be coming the market’s way.

- T2108 (% of stocks trading above their 40-day moving average): A low of 3.17% today is historically crazy. Lower than that of the December 2018 lows which came in at 3.45%. And that happened on a retest of the lows of yesterday which the market could not break.

- Moving averages (SPX): Currently trading below all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Eventually all the sectors turned green today, which was held back in part by the sell-off in Utilities early on. As you would expect following a 20% sell off in the Energy sector yesterday, it managed to lead the way 6% higher today. Materials, along with Technology managed to keep up and push the market higher as well.

My Market Sentiment