Swing Trading Strategy:

Tell me more about these ‘limit downs’?

So President Trump has a press conference, says some good feeling things, the market rallies, now, what if, and bear with me a second, what if we limit up tomorrow? The market is 20% off of its all-time highs, and you’re telling me you’ll limit up the market on a 7% melt up? Riot the streets if that happens!

Okay, back to reality – because everything I already said was just a random thought train. Here’s the thing, I reluctantly added two new positions to the long side. I didn’t like it, I didn’t like myself for it, but I’ve seen enough extremely bearish markets and times that were obvious capitulation moments for the market, that testing the waters today with a couple of long positions was definitely worth it from a risk/reward standpoint. Will they turn out to be profitable? I’m not sure! I’m not in the position of calling bottoms in this market, nor is anyone else, but I only trade what I deem to be favorable from a risk standpoint, in combination with the potential reward. If it works, then I add more long positions to the portfolio, but even then, I won’t completely buy into a recovery for the market, only that for the moment, the market is favorable.

Indicators

- Volatility Index (VIX) – A breathtaking move for the index today. It closed at 54.46, but hit 62.12 intraday. Here’s the thing, I haven’t seen that kind of level in over a decade. Sure it can go higher, but I question whether it can really reach 2008 levels. It took ten months to reach levels that 2008 did, so it is a little bit more difficult considering less serious circumstances that the VIX could reach such levels in under three weeks.

- T2108 (% of stocks trading above their 40-day moving average): Reached the 3’s today. That last happened at the lows of 2018. Only more bearish circumstances was the 1987 crash and the 2008 crash. This is a bounce level, I expect it to see a bounce from, but the market is under no obligation to follow what I think.

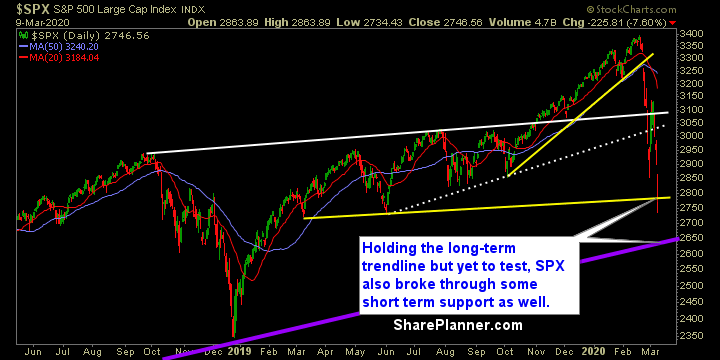

- Moving averages (SPX): Currently trading below all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Considering that I was one year removed from my start in trading when the Persian Gulf War started in 1990, when oil last crash more than it did today, I have never seen a sector take the kind of beating that Energy took today. It was down a crazy 21%. Individual oil stocks like Apache (APA) saw declines of over 50% today, as did Occidental (OXY). These are not run-of-the-mill penny stocks, these are stocks that are listed on the S&P 500. OXY, alone lost over $15 billion in market cap. That’s not normal folks. I still like how Technology isn’t selling off as much as other sectors, but situated firmly in the middle of the pack.

My Market Sentiment