Swing Trading Strategy:

Oh the places the stock market will take you.

For those who are just starting out in the stock market for the first time, you are witnessing some of the most volatile trading days that you’ll ever experience. You certainly can learn a lot from market turbulence like this. I’ve done it now for 28 years, and I’ll be the first to say that it isn’t worth being a hero in this kind of environment. Instead, I choose to make far less moves and trades in these kinds of markets. I trust the rice action less, and don’t get overly aggressive at all. In fact right now, I am sitting on 80% cash, because where this market goes from here is anyone’s guess. Sure there are plenty of people with opinions out there, and because the stock market can only go up or down, people will guess and hope to be right and then grandstand afterwards about it.

That’s not me. I don’t care about where the market is going next, only that I manage the risk along the way. At this point, no matter what the market does tomorrow, it is hard to justify any additional trades for myself. I don’t want to increase my long exposure, and shorting at these levels, with the VIX this high, doesn’t make much sense either. So I expect it to be a quiet day on the trading front, unless it involves closing out existing positions.

Indicators

- Volatility Index (VIX) – One of the longest periods with the VIX consolidating at abnormal highs that you’ll see. Right now now it is at recent closing highs and staying there. Usually you hit these peak volatility periods and you quickly retreat. But not so in this scenario. I still expect a hard sell-off in the VIX in the near term, as it is unlikely it can sustain this kind of reading for long.

- T2108 (% of stocks trading above their 40-day moving average): Considering we have a 117 point sell-off, the T2108 had an inside candle in relation to yesterday’s candle price action. It isn’t much, but it is a slight bullish divergence.

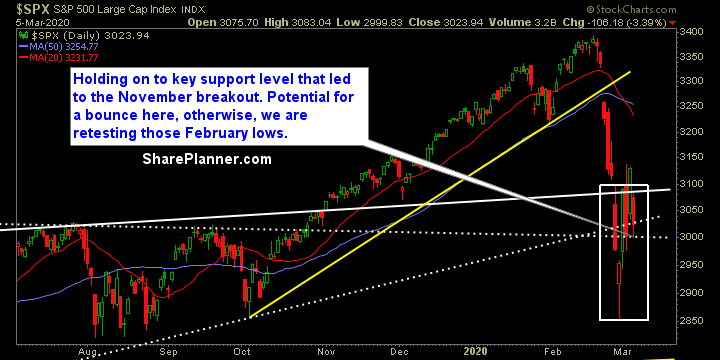

- Moving averages (SPX): Fourth straight writing about a break about the 5-day and 200-day moving averages. This time to the downside. Both of these MA’s have lost their value for gauging market direction over the past week.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Industrials and Financials continue to kill this market and both leading the market lower today. Technology, which usually leads sell-offs, was in the middle of the pack and actually had a slight amount of relative strength. For a fourth straight day, Utilities were at the top of the pack, followed by Staples, Telecom and Real Estate.

My Market Sentiment