Swing Trading Strategy:

I want to share with you, my notes that I shared with members of the Trading Block this morning, hoping it can be of some use for you as well…

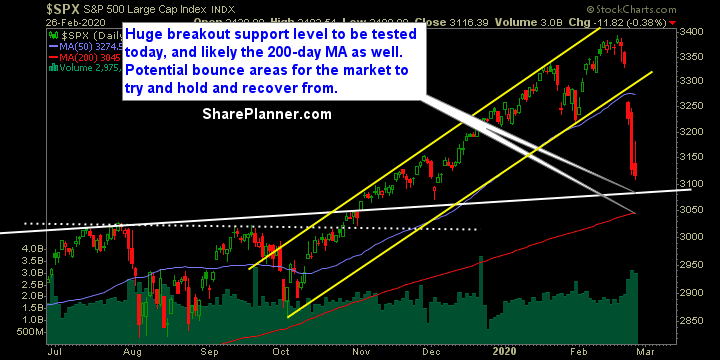

Another day where I am not putting any trade setups out there ahead of the market open. In a perfect world, I wouldn’t mind still holding on to those shorts that I had before, but I also know too, that rarely can you expect the sell-off in such a short period of time as we have seen here over the past week in the stock market. Overall, I am very happy with how my portfolio has performed here in this market. Another big sell-off today, and the market will have effectively surrendered its entire rally from the beginning of October. That is why managing risk and taking profits along the way is so, so important.

Yes, as mentioned already, we also have another day with no trade setups coming into the new trading session. I don’t think it is worth, from a reward/risk standpoint adding new short positions, because as we get closer to an eventual bottom, the snap-back/rally will be extreme, and will squeeze those short positions significantly. At this point, I am waiting for the complete ‘freak-out’ of traders and investors to play the long side again. Until that happens, I will likely stay on the sidelines, which is a really good thing by the way, because while everyone else is suffering, we have actually capitalized on the sell-off this week with our short plays. So be patient – trading is a game of patience, if you don’t have it, you won’t last.

Indicators

- Volatility Index (VIX) – The VIX is going to see a strong push into the 30’s. During the 2018 Q4 meltdown, the highest it ever got was 36, and it took a lot to get there. I’m don’t think it can sustain this kind of volatility for too much longer before we see a hard pullback.

- T2108 (% of stocks trading above their 40-day moving average): SPX finished 11 points lower yesterday, but it was enough to get the indicator down to 18%. Today it will be far worse and could, see single digits, at which point the potential for a hard bounce becomes very real for the stock market.

- Moving averages (SPX): Strong potential for a test of the 200-day moving average today. Also has been an area where the market has bounced over the past year.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was the only sector to finish in the green yesterday, but with Microsoft (MSFT) now warning, that isn’t going to be the case, especially when you consider how much weakness there is today. Energy continues to take the brunt of the selling. All sectors are in a full breakdown now, with none being spared, not even Utilities or Real Estate.

My Market Sentiment