Swing Trade Approach:

Another busy day as I closed Vertex (VRTX) at 232.69 for a +6% profit, Virgin Galactic (SPCE) for a +6% profit, I took some profits in my Square (SQ) trade for a +8% profit, and reduced my exposure in my Spotify (SPOT) trade by taking a portion of that trade off for a -5% loss. Market looking to push lower, and will be aiming to add additional short exposure while capitalizing on my existing short trades.

I don’t doubt that the bulls could bounce this market today, but I also think it creates the perfect opportunity for them to get trapped trying to buy the dip today, by buying early and then getting killed on the afternoon drop. I don’t personally like the day after the FOMC statement as it can often times does what you least expect. Or so it seems to me at least. I’ll still trade it if the right opportunity comes along, but will certainly be cautious.

Indicators

- Volatility Index (VIX) – VIX bounced off of the declining trend-line (support) off the August highs of last year. With today’s market weakness, VIX looking to push higher and possibly challenge the YTD highs.

- T2108 (% of stocks trading above their 40-day moving average): Very weak action in this indicator, as stocks are not recovering very well off of the recent sell-off, and could, even see some sub 40% readings in the days ahead.

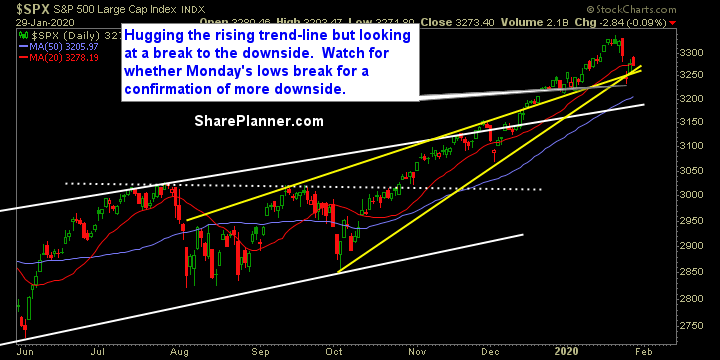

- Moving averages (SPX): Unable to sustain its move above the 5-day moving average after Jerome Powell’s presser, and now back below the 20-day moving average. Bearish look for the overall market.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy closed below the rising trend-line from August, and now is challenging the lows from December. Incredible how oversold this sector is and how unwilling it is to even show signs of bouncing. Avoid this sector. Materials continues to fall apart in similar fashion to that of Energy. Telecom just established a lower-low. That is problematic as well. Possible head and shoulders pattern developing in Healthcare. Financials still below its short-term topping pattern, and should still see further downside. Staples with a lower-low in place.

My Market Sentiment

Expect some major support levels to be broken today and if the lows from Monday breaks, it will cast a major shadow on this market going forward.