Swing Trade Approach:

I closed out the second half of my short position in Walt Disney (DIS) today for a +3% profit. I also added two new long positions while closing out one other long position in Levi Strauss (LEVI) which was one of more bizarre acting stocks that I have traded in some time, taking a loss of -2.8%. I’ll be trading light tomorrow with the FOMC statement coming out tomorrow and will wait for the presser to come and go before considering any new long or short positions.

Indicators

- Volatility Index (VIX) – VIX dropped nearly 11% today following a major rally in stocks. Good chance for additional downside in the VIX in the coming days. More likely than not, VIX keeps pushing towards the 12-13 range again.

- T2108 (% of stocks trading above their 40-day moving average): Not a huge bounce in this indicator today, even with the market rally. A 7% rally to settle at 48. Still more than half of stocks trading below their 40-day moving average.

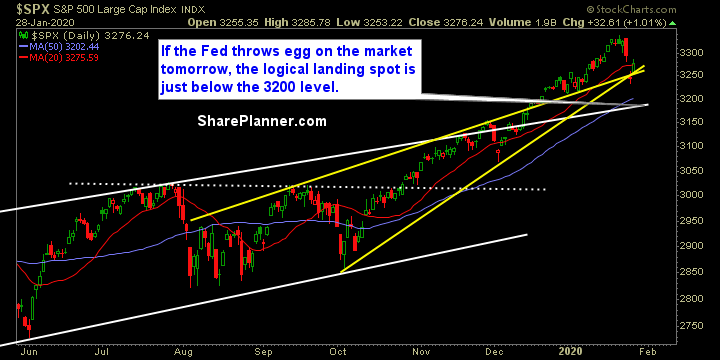

- Moving averages (SPX): Barely managed to close above the 20-day moving average and setting up for a retest of the 5-day MA tomorrow.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Broad based rally today with the two most important growth sectors leading the way: Technology and Discretionary. Defensive sectors took a back seat as is normal during a strong market rally. Energy hardly bounced today, which was a disappointment, but could still be in play tomorrow.

My Market Sentiment

SPX bounced off of rising support today, and sets up for another push towards the all-time highs. The FOMC statement tomorrow will be key to setting the tone for the markets going forward and the rest of the week in particular. As a result, until the even passes, it is best to remain on the sidelines before placing any new trades.