Swing Trade Approach:

I added one long position yesterday, not the best start to the trade, but I also took 1/3 of my position in HD off the table for a +5.2% profit. Still building that balance between long and short positions right now, and not looking to get overly extended to the long side at this point until this virus in China plays itself out. Managing existing trades will be the top priority at this point. I do thing that the morning weakness could be quickly bought up today.

Indicators

- Volatility Index (VIX) – Small bounce in the VIX yesterday, finishing at 12.91. Still very well contained at this point.

- T2108 (% of stocks trading above their 40-day moving average): This indicator shows that stocks have pulled back over the last three days, dropping another 4.2% yesterday down to 61% and from a high of 73% on Friday.

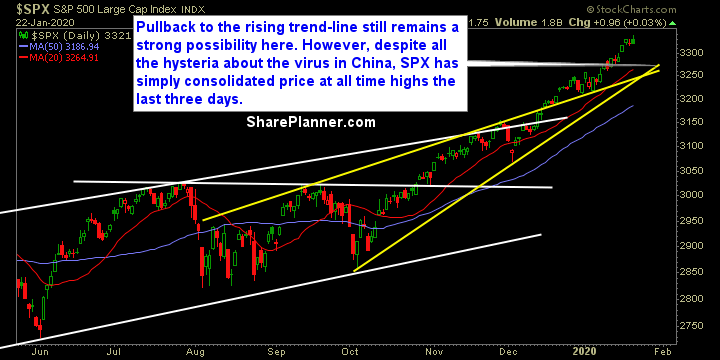

- Moving averages (SPX): Trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy continues to breakdown, and looks like there will be more of the same today. It is possible that a retest of the August/October lows are made here in the coming days. A lot of money still flowing into Utilities and Telecom as well. Industrials have seen a hard two-day pullback. Most other sectors are simply consolidating.

My Market Sentiment

Still that pullback to the rising trend-line seems very possible here, and probably help provide better trade setups going forward. However, price has yet to show any indication it wants to take the virus that is spreading in China seriously. Utlimately, it’ll probably not mean much to this market, and will just be a quick ‘blip’ on the radar. Right now all the major moving averages are holding and no significant levels of support have broken or even been tested for that matter.