Swing Trade Approach:

Quiet day on Friday for me, until the end, when I booked some profits in Suncor (SU) for +3.3% in profits. Netflix (NFLX) was another profitable trade, and one that I had to take profit son with earnings on Tuesday. The profits taken from that trade was for +2.8%. But the best part of the trade was taking a 1/3 of my position off the table in ETSY (ETSY) for a +12% profit. Overnight futures are lower as of this post, and while I’m not against a new long position, I have, in recent days, been trying to find places where I can book profits. I’ve got a handful of short setups that can be in play in the case of a large market sell-off, and a few already in the portfolio, so I am not unprepared if things start to go south in a hurry.

Indicators

- Volatility Index (VIX) – Just sitting in the lower 12’s. Can dip below 12 intraday, but can’t sustain the move below. Starting to look more prime for a bounce with the long, lower shadows on the candles.

- T2108 (% of stocks trading above their 40-day moving average): Down to 70% but still elevated and strong. Needs to break above 75% to really separate itself from past rally attempts.

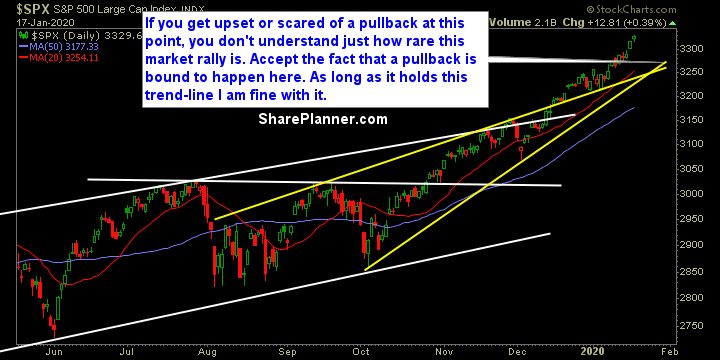

- Moving averages (SPX): Trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities are as bullish as it gets. While other sectors might be slowing down some, this sector continues to rip higher for a 7th straight day. Financials finally broke out. I have renewed hope for this sector. Real Estate looks like it could have itself a pullback in the near-term. Energy still sucks, and haven’t showed any signs of wanting to bounce.

My Market Sentiment

The market is getting quite parabolic – the path for a pullback is seeming more realistic. Sure you might get stopped out of a few positions along the way, but it makes it worth it in the long run, when some of the buying pressures are alleviated.