Swing Trade Approach:

Overall a profitable day. I scaled back a tad, my long exposure, while keeping my short exposure the same. Still, I’m not against adding more positions here, but I have no desire to take on a ton of new long positions. I sold half my position in Shake Shack (SHAK) for a +12%, sold half of my Visa (V) position for +8%, while kicking Burlington (BURL) to the curb for a flat trade, and selling KeyCorp (KEY) for a 3% loss.

Indicators

- Volatility Index (VIX) – Another fade off the highs of the day. Eventually a big day will be had, but for now the market seems content with keeping volatility near the lower 12’s.

- T2108 (% of stocks trading above their 40-day moving average): A good 4% pop higher, sends this indicator to 65%.

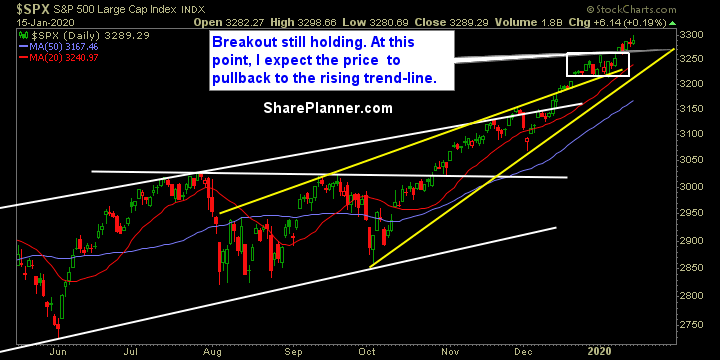

- Moving averages (SPX): Trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

My favorite sectors in the market are: Technology, Healthcare, Utilities, Discretionary. Stay away from new Energy positions, and Financials, as well as Materials – they are lagging the market overall.

My Market Sentiment

SPX continues to rip higher day after day, and has yet to see back-to-back days of selling this year. Market certainly at the stage, where booking some profits where the opportunity provides it makes sense. The rally seen in December, is going to be hard to match in terms of euphoria. However, that doesn’t mean the market is in imminent danger of selling off here. So remain aware, and ready to act, should the need occur.