My Swing Trades

A bunch of trade setups triggered today in the Splash Zone. One in particular that was my favorite was the almost 6% pop in Trinity Industries (TRN). Still waiting for Splunk (SPLK) to break out but long last it looks like it is falling apart without ever the chance of breaking out of the continuation triangle pattern it was in. Another favorite continues to be Graco (GGG) but likely to see some resistance in the $50-51 range.

Indicators

- Volatility Index (VIX) – Starting to give up its big gains from Monday for the past two days. Disappointing because this market could actually use a little volatility to shake things up. Currently at 15 on a 4.4% drop.

- T2108 (% of stocks trading above their 40-day moving average): Can’t go higher, and can’t seem to sustain a move lower. Just stuck in the eternal 50% range.

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy finally handed over the baton to Materials today. I still think the former has some potential upside to it, but needs to definitively break through the heavy resistance created by the downtrend off of the April highs. Healthcare continues to consolidate at its all-time highs. Very healthy chart with the consolidation unfolding and setting up for another push higher.

My Market Sentiment

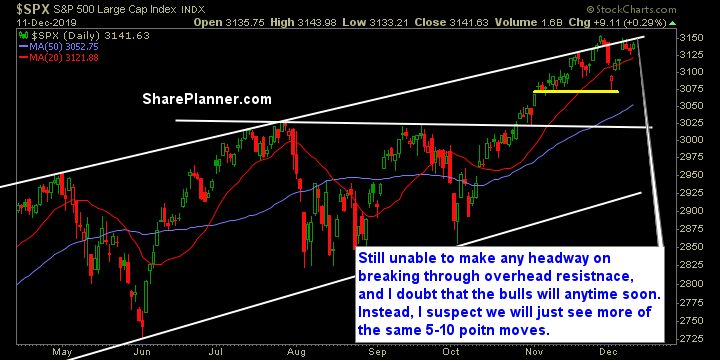

You have rising resistance overhead that continues to stunt any major price moves to the upside and this has been going on for the better part of a month now. Until that changes, I expect the market to have price moves that are very measured and contained.