My Swing Trading Strategy

Busy day yesterday, I started the day out long and strong, and just following price action, managed to somehow end the day with just a short position remaining in the portfolio. I closed Tesla (TSLA) for a +4.6% profit, then I closed Alibaba (BABA) for a +2.1% profit, McDonald’s (MCD) for a +1% profit and a Day-Trade in Square (SQ) for a quick +1% profit, and closed my long suffering position in Gold (GLD) for a -2.7% loss. Overall a good day of profit collecting, and I added a short position as well, and will be looking to add new positions in either direction depending on what the market has in store today, but also a good chance I won’t be adding anything.

Indicators

- Volatility Index (VIX) – Once again trying to perk back up on a day where the market traded higher. This is the third time $VIX has been up over the last four trading sessions.

- T2108 (% of stocks trading above their 40-day moving average): Fewer and fewer stocks are participating in this market rally. Breadth was horrible yesterday, and dropped another 2.2% on the T2108 to 57%. Not ideal, because this isn’t taking place where the market is trying to consolidate price but continues to give up morning gains to the afternoon price action.

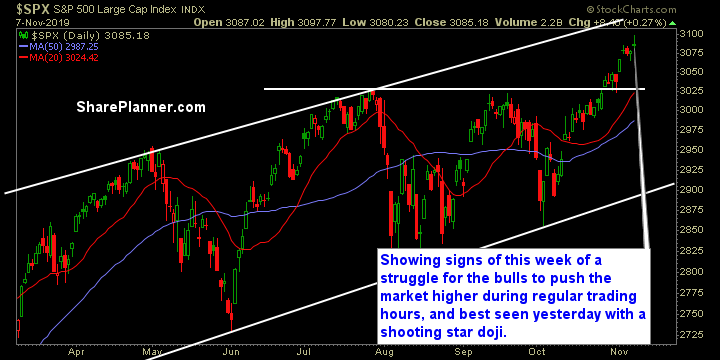

- Moving averages (SPX): Trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

While weak the day prior, Energy reemerged as the market leader yesterday, but there is a lot of declining resistance overhead that it just doesn’t seem able to break at this point. Technology had a gravestone doji candle yesterday, which lets be honest, is never the candle you like to see in an extremely overbought rally of any kind. Caution warranted there. Financials could certainly rally higher, just like any index can, but at this point, it is getting a bit detached from reality, and any sizable gains from here with out a pullback first, is probably wishful thinking. I suspect we’ll soon see a bounce in Utilities.

My Market Sentiment

Shooting start doji candle yesterday, and despite the market trading higher, the breadth was horrible for a day in which the stock market was positive. So there does seem to be a little bit of a tightening of the purse strings until a pullback can be had, or at the very least some consolidation. You’re also starting to see signs of negative Chinese headlines yet again and the market acting negatively to positive economic news, because it would prefer bad news that persuades the Fed to cut interest rates again, rather than good news that makes them keep rates the same.

- 1 Short Position