My Swing Trading Strategy

I added one short position to the portfolio, not sure if that will be instant regret today or not, with the futures spiking, but it is the only short position in the portfolio, so it isn’t too bad. I’ll look to add possibly one additional long position today considering how the market performs in the early going.

Indicators

- Volatility Index (VIX) – VIX popped 7.2% which is one of the biggests gains for the month of October, but gave up even more gains in the final hour of trading yesterday. A constant theme for this market that continues to avoid any true sell-off in equities.

- T2108 (% of stocks trading above their 40-day moving average): This divergence is what continues to blow my mind. Stocks under the surface continue to weaken. A 7% drop in thsi indicator yesterday, broke down and below the 8-day range it had been trading in. Current reading is 55%. a

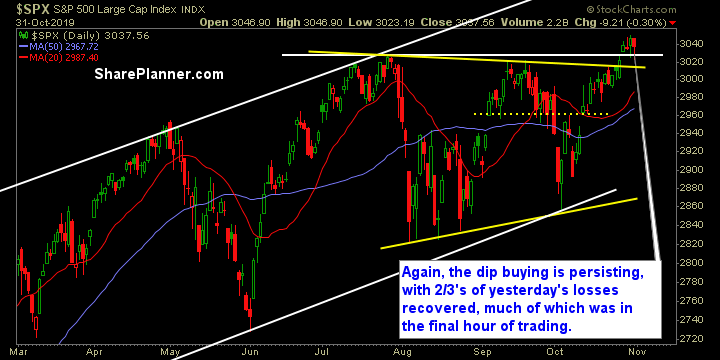

- Moving averages (SPX): Trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

The safe sectors continued to catch a bid yesterday just as it did the day before that. Industrials saw the most amount of selling which isn’t surprising because they are probalby one of the biggest targets right now for profit-tdaking. Financials also weakened some, but as with all the sectors, the rally in the final 10 min of trading threw everything off, and now there is a large gap higher ahead of the open, which could create another buying free-for-all.

My Market Sentiment

Hard sell-off early on for SPX, but by the close the bears proved once again it was incapable of holding a loss below the 5-day moving average.

- 3 Long Positions, 1 Short Position.