My Swing Trading Strategy

With FOMC yesterday, I didn’t add any new swing-trades to the portfolio yesterday. I instead sat on my hands and let my current positions increase in profits. There are a few particular stocks that I have my eye on today for possible entries.

Indicators

- Volatility Index (VIX) – The sell-off in the VIX is getting intense with yesterday dropping another hard 6.6% to close at 12.33. This level hasn’t been seen since 7/26 which ultimately led to an immediate spike higher and a sell-off in equities. These are levels to be very concerned with SPX and the potential for a sell-off.

- T2108 (% of stocks trading above their 40-day moving average): Another day where the market rallied higher to new all time highs, but T2108 and breadth in general was weak. Closed at 59% following another 2% decline. Stuck in a tight range for the past two weeks.

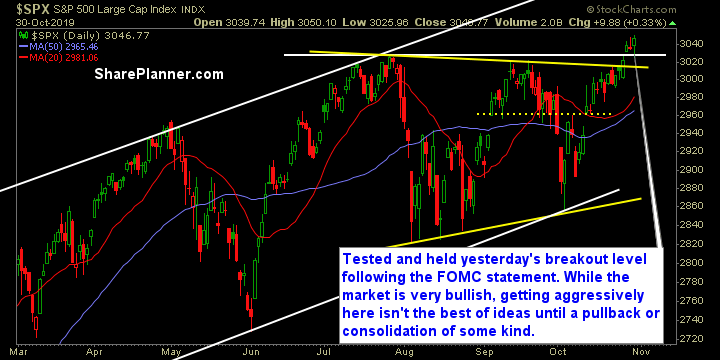

- Moving averages (SPX): Trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Capital is starting to flow back into the safer sectors with the price action seen yesterday. While sectors like Utilities, Real Estate and Staples all performed well, Technology continued to rally hard and unaffected by the market’s willingness to focus more on risk-adverse sectors.

My Market Sentiment

Another rally thanks to the help of the Federal Reserve and its very dovish policy. Support at the breakout level held and bounced following the FOMC Statement. Very overbought, volume very light, and I’m not overly confident of a lot more upside.

- 3 Long Positions.