My Swing Trading Strategy

I don’t have any new positions in my portfolio from Friday. Watching today to see how serious the bulls are about holding on to these new all-time highs. Considering 1-2 new long positions to the portfolio.

Indicators

- Volatility Index (VIX) – VIX dropped 7.8% and likely to drop further, which is creating a very low volatility market and could even see a move into the 11’s.

- T2108 (% of stocks trading above their 40-day moving average): A 2.5% last session taking it up to 59%. Not overly bullish relative to July and September readings.

- Moving averages (SPX): Trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology showing a lot of strength today, but Industrials really seeing a lot of buying interest, while your traditional safe sectors, Utilities, Staples, Real Estate are really seeing capital flow out. Healthcare still remains in question.

My Market Sentiment

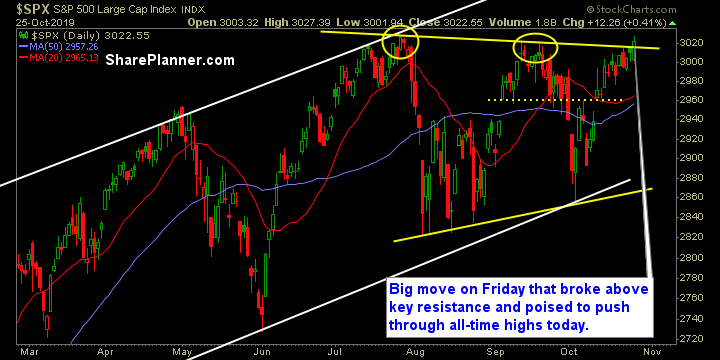

A three week rally on the indices has taken price above declining resistance and now likely to break through all-time highs at the open today. While its likely there won’t be major moves higher at this point. There are a number of earnings reports this week, FOMC, and the potential for China headlines that could quickly turn the tide against the market, but that is impossible to predict ahead of time.

- 1 Long Position.