My Swing Trading Strategy

I added a long position yesterday in one of the commodities that’s breaking out. Looks to open up well. Watching for whether the bears can grab a foothold on this overbought market, in the wake of weak Amazon (AMZN) earnings, and if so, may look to add 1-2 new short positions to the portfolio.

Indicators

- Volatility Index (VIX) – A low volume market, and a 2.1% decline sends the VIX back to 13.71. Rising trend-line off of the April lows, creates a scenario of a possible bounce here.

- T2108 (% of stocks trading above their 40-day moving average): Despite yesterday’s market rally, breadth was negative, and notably so. A decline of 5% taking the indicator back below 58%. Keep watching for further divergence in this indicator.

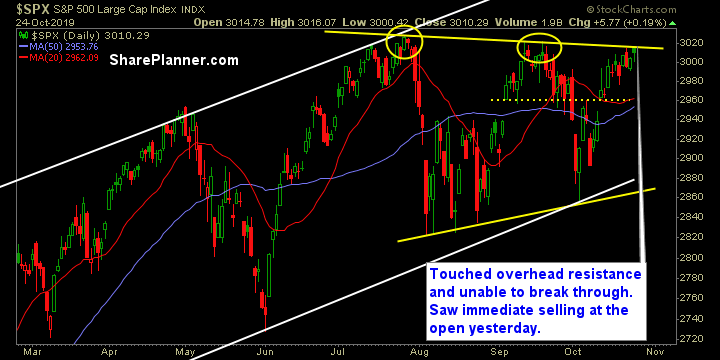

- Moving averages (SPX): Trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology finally showed up yesterday, as both Semis and Software stocks rallied extremely hard, despite stocks like Apple (AAPL) doing absolutely nothing. Telecom showing some more weakness of late,and the big drag on the market. Some concern creeping up with this as AT&T (T) and others are really dragging the sector down.

My Market Sentiment

SPX tested overhead resistance yesterday, but could not break through, instead the sell programs hit the market quickly. I’m interested in seeing how the Amazon earnings impacts the market today, and whether the market continues to buy the dip if more companies disappoint in their earnings.

- 1 Long Position.