My Swing Trading Strategy

I closed one short position out yesterday, following its stop-loss being hit, but added another that is off to a solid start following yesterday’s drop. I will look to add more short exposure should the market want to drop further today, and continue yesterday’s slide. However a break above key resistance noted below in the the SPX chart, and I’ll consider adding long exposure.

Indicators

- Volatility Index (VIX) – Bounce area in VIX of 3.3%. Not significant but could be setting the stage a bounce similar to what was seen back in September.

- T2108 (% of stocks trading above their 40-day moving average): Breadth on NYSE was still positive yesterday despite the market decline, in large part due to small caps. The T2108 saw a mild decline of 2%, which is nothing to get worked up about. Holding recent gains, but still a massive divergence on the chart.

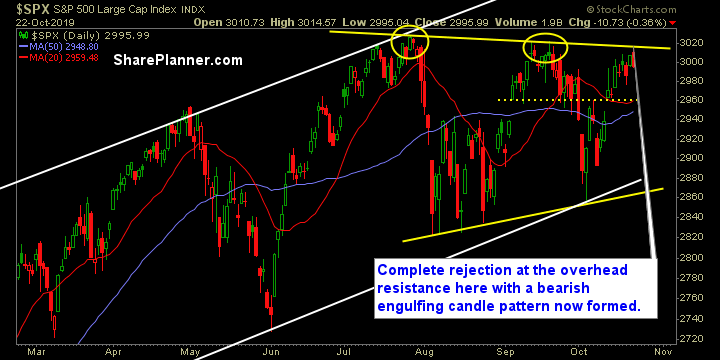

- Moving averages (SPX): Tested and held the 5-day MA the past two trading sessions and above all other major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Market continues its trash rally, with Energy leading the way. Saw some flight into Utilities following a solid earnings report out of NextEra Energy (NEE). Technology continues to lag, and everyone and their moms are getting out of software stocks. Healthcare has been another trash sector in 2019 that is still attracting buyers, though yesterday’s candle had a hint of bearishness to it, considering how much of its daily gains it gave up.

My Market Sentiment

Finally seeing some notable weakness on SPX. Though it wasn’t a ton, it was a bearish engulfing candle of the previous day’s price action. Also happened right at key resistance for SPX overhead, as has been the case going back to the July highs. This is where you want be more aggressive with the profit taking.

Current Stock Trading Portfolio Balance

- 1 Short Position.