My Swing Trading Strategy

I went for a day-trade yesterday, but the volume in the overall market deteriorated too quickly for me to make much of the trade. Got in, got out, and no new positions held overnight. Watching for the same again today, whether the bulls can break out to new highs and through overhead resistance.

Indicators

- Volatility Index (VIX) – Started off strong yesterday, but quickly fell back to 14, giving up 1.8%. Zero volatility in this market as each intraday dip is quickly bought up.

- T2108 (% of stocks trading above their 40-day moving average): A 6% increase, which is light considering the extent of yesterday’s move. This indicator is flashing a lot of warnings here, about the overall health of the market.

- Moving averages (SPX): Back above the 5-day moving average and all other major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy now is starting to catch a bid much like Healthcare did last week. Simply put, the market is looking to the most downtrodden sectors of 2019 and buying them up at a ferocious pace. Technology, while it did well yesterday, seems to be lacking the overall enthusiasm that the rest of the sectors have recently shown.

My Market Sentiment

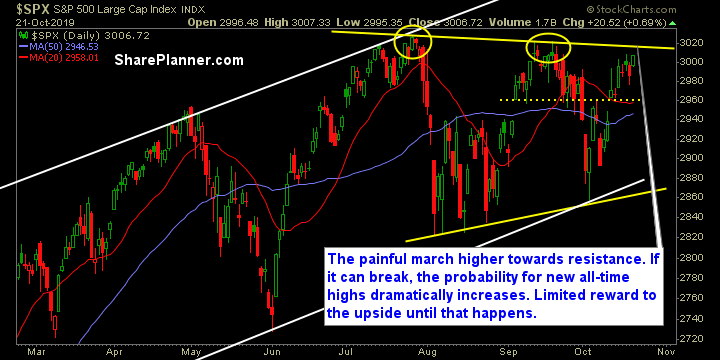

Ready to test some resistance following Monday’s rally. After that it sets the stage to challenge the all-time highs. Neither of which will be an easy task. Light volume continues to drive the market higher, but the headline risk looms large on a sudden and huge sell-off.

Current Stock Trading Portfolio Balance

- 1 Short Position.