My Swing Trading Strategy

I added some short exposure yesterday. as SPY finds itself just barely in the gap after yesterday’s close and appears willing to give the gap fill a try from Friday. Not seeing myself being overly aggressive on the trading front, but could take advantage of some opportunities either long or short today.

Indicators

- Volatility Index (VIX) – With the low volume invading the market again yesterday, and minimal price action, VIX took a big hit with 6.5% to the downside, and now rests at 14.57. Get into the 13’s and that is where you have to start worrying about a significant sell-off in equities.

- T2108 (% of stocks trading above their 40-day moving average): Following Friday’s 26% rally, there was some give-back here yesterday with a 6% drop taking it back below 50%. Not an overly good look for a market that is only 2% below its all-time highs.

- Moving averages (SPX): Price is currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Financials showed relative strength yesterday on earnings hopes today, that doesn’t look to be really panning out as the earnings from that sector is somewhat mixed. Real Estate continues to be a market safe haven for now, as investors aren’t fleeing the usual Utilities. Again, Energy is to be avoided. The sell-offs in oil are far too large and unpredictable to be taking any meaningful long position in.

My Market Sentiment

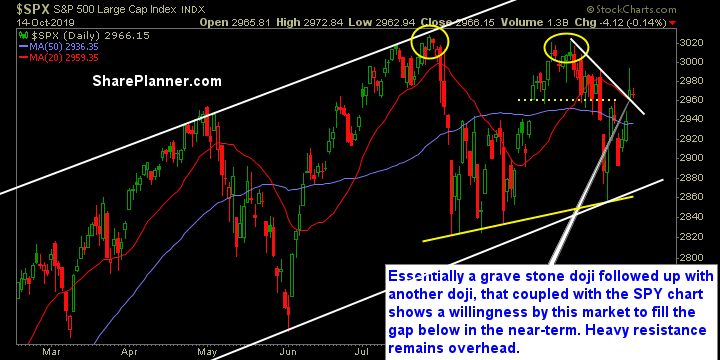

SPX continues it struggles just below the all-time highs, plus, you still have a double top and head and shoulders pattern in play. But the chop is real, and on a day-to-day basis, the market has a more neutral feel to it, even though the longer-term outlook has a distinctive bearish look to it.

Current Stock Trading Portfolio Balance

- 1 Short Position.