My Swing Trading Strategy

I didn’t take any new trades on Friday, as it looked foolish to me to chase price ahead of the Trump/China trade negotiations. I am leaning more bearish heading into today and may look to get short again at some point today.

Indicators

- Volatility Index (VIX) – A 13% drop on Friday, that didn’t see much upward momentum when there was an end of day sell-off. That surprised me actually. Currently at 15.58, is likely to see another retest of 20 in the near future.

- T2108 (% of stocks trading above their 40-day moving average): A big 26% rally, but still saw nearly a 40% decline in its gains prior to the close. Still sitting at 52%, which isn’t overly bullish or bearish.

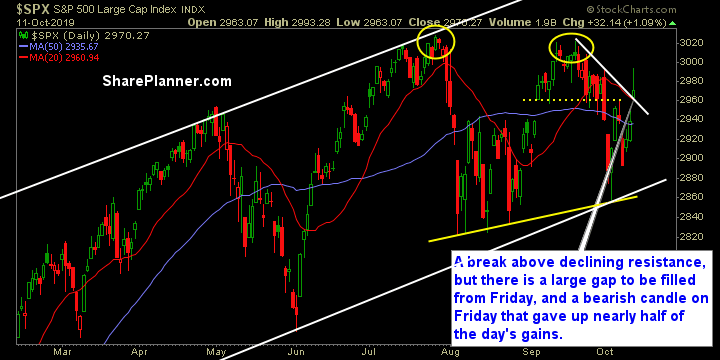

- Moving averages (SPX): Price is currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Industrials led the way, while money fled out of safer more dependable sectors of late, such as Utilities, Staples and Real Estate. Very few sectors at this point have any legitimate trend-lines in place, and instead we are seeing sideways price action that continues for the past 7 months on average.

My Market Sentiment

End of day sell-off after the China news broke, and could lead to additional follow through today. The market is showing a huge propensity to buy the rumor and sell the news.

Current Stock Trading Portfolio Balance

- 100% cash