My Swing Trading Strategy

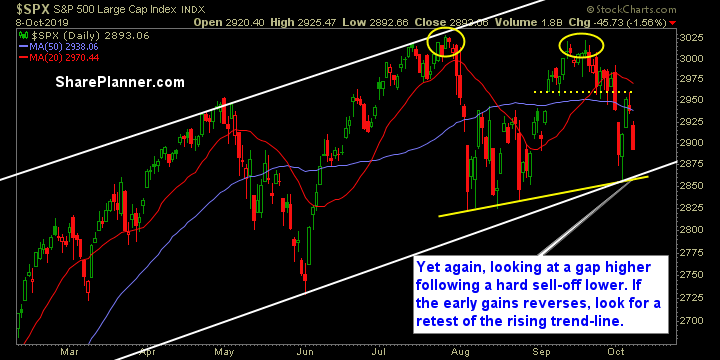

I added one short position yesterday and starting out with a solid profit. Today’s gap higher (of course!) will threaten those gains, but will wait and see how the market handles the gap higher, as the tendency of late has been to fill any and all gaps. I’m open to adding to my short exposure, but if the market reverses matters from what we saw yesterday, will also look at a small long position. At the expense of trying to cover all the bases, I may simply stay put and not take any new actions today, if the market offers little to no clues on forward direction.

Indicators

- Volatility Index (VIX) – Declining resistance off of the August highs could come into pay here. Will need to break 21.20.

- T2108 (% of stocks trading above their 40-day moving average): A massive sell-off of 27% yesterday sent the indicator back down to 34%. A break of Thursday’s lows would set up for the support test from of the June lows.

- Moving averages (SPX) Broke back below the 5-day moving average and very possible we see a test of the 200-day moving average. .

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology saw the biggest hit yesterday, along with Healthcare which has been one of the market’s weakest sectors of late. In terms of relative strength in the market, investors run to the traditional “safe” sectors that included, Utilities, Real Estate, Staples and Telecom. Continue to stay away from Energy as it remains the dog of the stock market.

My Market Sentiment

If the pre-market strength reverses, which certainly is possible based on the market price action of late, a retest of the rising trend-line could take place today. Watch for a break of Monday’s highs to get “more” bullish.

Current Stock Trading Portfolio Balance

- 1 short position.