My Swing Trading Strategy

I took profits in my two-day trade in Twitter (TWTR) for a +1.3% profit. Not a ton (but more now with free commissions of course ?) but considering that the market is looking at a significant gap lower this morning, it confirms my concern with the market going into today. I will be looking to possibly get short early into the trading session.

Indicators

- Volatility Index (VIX) – The 4.8% pop yesterday in the VIX keeps the momentum over the past two weeks in the VIX (to the upside) intact for a move back above 20.

- T2108 (% of stocks trading above their 40-day moving average): More evidence that the recent rally was a dead cat bounce, the T2108 dropped 5.2% yesterday to form a shooting-start like candle (though it is inside the previous candle pattern – you get the point though).

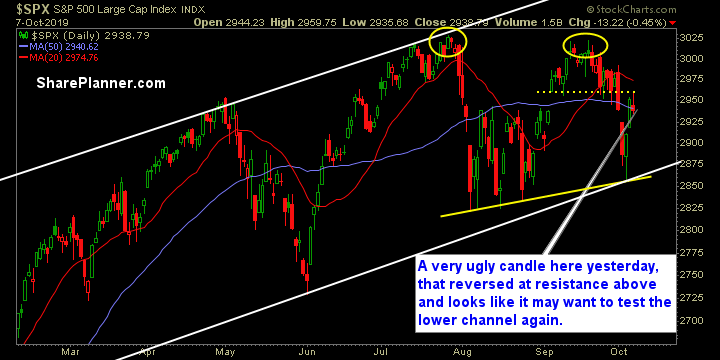

- Moving averages (SPX) After holding it for just a day, price fell back below the 50-day moving average, and likely to test the 5-day MA today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology hasn’t been as weak as some of the other sectors of late, like Energy or Discretionary, though every sector finished lower yesterday. Again, there is little reason to be playing the Energy sector at this point in time, and Financials should be avoided as long as bonds keep their rally up.

My Market Sentiment

Rising channel more than intact for now. However, the retest of the channel could certainly happen again soon should today’s weakness hold through the close. Yesterday’s candle has all the makings of a reversal candle.

Current Stock Trading Portfolio Balance

- 100% cash.