My Swing Trading Strategy

I added one new long position and also a short position to hedge against any possible market sell-offs today. At this point, I have enough long positions in the portfolio, and will look to simply manage the portfolio’s current positions rather than adding any additional positions today.

Indicators

- Volatility Index (VIX) – The declining trend-line off of the August highs was tested in the previous trading session but saw price rejection in the final hour of trading. Still heavy resistance there, and will take a notable sell-off to break and sustain a move above resistance. Still it managed to close 7% higher at 17.22.

- T2108 (% of stocks trading above their 40-day moving average): Pulled back to the declining trend-line off of the February highs. A 6% decline in the previous session has the indicator sitting at 61%. If we are to see a bounce, it needs to happen here. Otherwise the chart gets very messy.

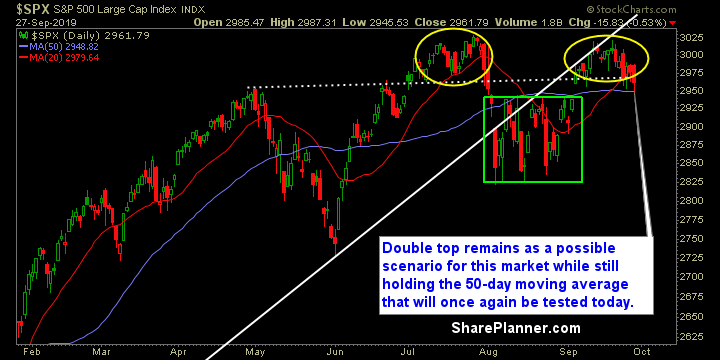

- Moving averages (SPX) Bounced off the 50-day moving average but closed well below the 20-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Only one sector finished higher on Friday, and it was Energy despite a 1% sell-off in oil. You could make the argument that a bull flag has formed, and possible that we see a bounce here off of its 50-day moving average. Staples remains in a very tight trading range right now, over the course of September. Real Estate continues to hit new all-time highs as does Utilities. Healthcare should be avoided here at all costs. The sector looks like a mess and starting to break below the August lows.

My Market Sentiment

You have a linger possibility of a double top formation coming into play. However, it won’t take much to nullify it, with a move beyond current all-time highs. The 50-day moving average continues to hold strong, and the tap from 9/5 came close to filling but not quite. Headline risk in regards to China and the possible Trump impeachment still lingers and will hap an impact going forward.

Current Stock Trading Portfolio Balance

- 4 Long Positions, 1 Short Position.