My Swing Trading Strategy

I didn’t add anything new to my portfolio yesterday, and may not even do so today. The market has to provide some direction – some conviction. Right now, it has been lacking that as it has sold off four of the last five days. It is showing a willingness to bounce today, and if it can hold and start pushing higher once again, I’ll be open to adding another long position.

Indicators

- Volatility Index (VIX) – Volatility pushed its way back to 17 yesterday but quickly gave way back towards the lows of the day to form a doji candle. I think there is more of a push at this point to see 13 before we see a move above 18.

- T2108 (% of stocks trading above their 40-day moving average): A solid push lower of 5% that took the indicator down to 65%. Again, not a game changer for this indicator, as it remains in consolidation over the past twelve trading sessions.

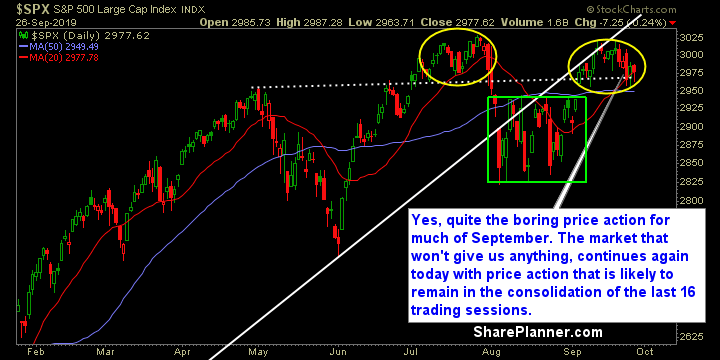

- Moving averages (SPX) Closed right on the 20-day moving average but unable to sustain its break above the 5-day MA. The 50-day MA could easily be tested at any time.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

It was a flight to safety yesterday, as Real Estate, Staples and Utilities were the only sectors to march higher. Despite the selling yesterday, and it wasn’t a ton, in the overall market, Industrials and Technology didn’t lose much ground at all. Stay away from Healthcare stocks at this point as the last four days have seen a sudden breakdown in price and threatens to test the August lows and possibly more. Energy stocks continue to be a deathtrap of headline risk as it is likely to push lower today for the eighth time in the last nine trading sessions.

My Market Sentiment

This has really been a boring month of trading, riddled with plenty of headline risk, and crazy headlines. Possible that we have a double top, but any selling pressures of late has lacked volume and downside conviction. While the market only sits a couple of percentage points below its all-time highs, it can’t seem to muster enough enthusiasm to break through and establish new ones. Instead, the market remains in a consolidation much like August where price just can’t sustain a move in either direction.

Current Stock Trading Portfolio Balance

- 4 Long Positions.