My Swing Trading Strategy

It was a relatively quiet day of trading for me yesterday as I didn’t book any gains, and added only one new position to the portfolio. The market, as it sits a shade below its all-time highs, isn’t providing a ton of clues or showing any substantial conviction as to what it wants to do going forward, so I have been careful about not getting myself over exposed in my portfolio by having too strong of a bias.

Indicators

- Volatility Index (VIX) – Dropped 2.7% yesterday yesterday, while the market remained muted and break even all day. A lot of support in the lower 13’s still.

- T2108 (% of stocks trading above their 40-day moving average): A very small uptick higher, as breadth was slightly positive. The indicator remains at 70%, is much higher than we have seen at any point in the last seven months.

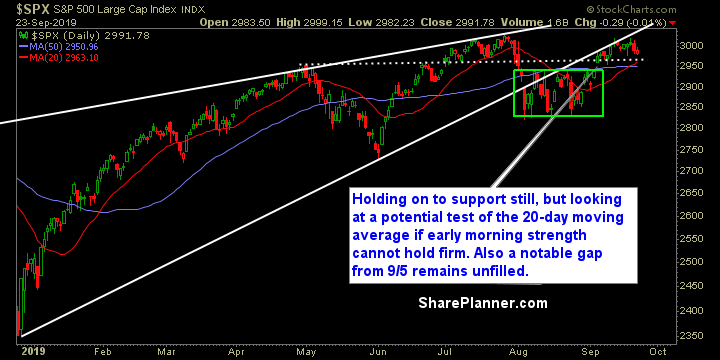

- Moving averages (SPX) Resistance at the 5 and 10-day moving averages – with a potential downside crossover possible today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Staples saw the most amount of buying, while forming a nice bull flag pattern off of the 20-day moving average. Real Estate continues to hover at its all-time highs, while Utilities have made new all-time highs four days in a row. Energy has come close to filling its gap from last week’s huge rally. Discretionary could be forming a triple top pattern and over the last eight months has essentially been range bounce in a very wide range.

My Market Sentiment

An afternoon rally was squashed by an end-of-day sell-off to take price just barely negative and essentially unchanged. There is a gap from 9/5 that remains unfilled at this point and seems like a logical destination for price to attempt at filling.

Current Stock Trading Portfolio Balance

- 2 Long Positions, 1 Short Position.