My Swing Trading Strategy

I took profits yesterday in BABA for a +2.3% profit, while getting knocked out of another long position at my stop following the China news that hit the wire. I still have one long position and one short position – both of which are holding respectable profits. If the market continues to sell-off today, may look to increase my short exposure as a result.

Indicators

- Volatility Index (VIX) – A 9% pop on the VIX in the previous session, which was a sizable bounce considering how shallow the pullback in equities were. In the short-term the 13 level continues to hold.

- T2108 (% of stocks trading above their 40-day moving average): Down five of the last seven trading sessions, but hardly giving up any ground. Breadth isn’t seeing any dismantling or any significant profit taking. With that said, equities have been up four of the last seven sessions.

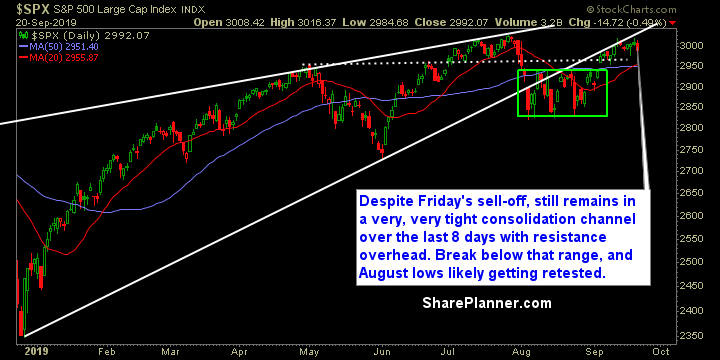

- Moving averages (SPX) SPX broke the 5 and 10-day moving averages, both of which are starting to curve lower.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Your main growth sectors continue to see the buyers avoid them – that being Technology, Industrials and Discretionary. The continued struggle in these three sectors has traders feeling that a pullback is near. Bulls continue to flee to Utilities and Real Estate while Healthcare continues to attract buyers. Energy bull flagging following its rally from last Monday and the week prior to that.

My Market Sentiment

Friday’s price action was the first sign that the bulls may be starting to weaken beyond just normal consolidation. However, for it to take hold, will need to break below the lows of 9/11. Once that happens, it is likely you’ll see a retest of the 9/11 lows. Historically speaking, the week following September OPEX is down 23 of the last 29 years.

Current Stock Trading Portfolio Balance

- 1 Long Position, 1 Short Position.