My Swing Trading Strategy

Three of my four positions increased in value yesterday, the other was stopped out by the volatility created by the FOMC Statement. I’ll be looking to add one new position to the portfolio today, possibly two.

Indicators

- Volatility Index (VIX) – a 3.4% decline yesterday pushed the VIX just below the 14 level again. Still holding to the theory we’ll see 11-12 again before any major sell-off in equities.

- T2108 (% of stocks trading above their 40-day moving average): Despite a positive finish, the breadth in the market was poor, and it was reflected in the 2% decline in the indicator. Currently sitting at 71%.

- Moving averages (SPX) Tested and even broke, intraday, below the 5-day and 10-day moving averages. In the end the dip buyers came in and saved the day.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Despite a positive finish yesterday for the S&P 500 and Dow, only two sectors finished higher – Utilities and Financials. All the other sectors saw some form of selling yesterday, though for the most part it was quite mild. I would stay away from playing Energy for now. It is very unpredictable and at the mercy of headline risk. Financials look like they could be primed for another leg higher here. Industrials have a nice bull flag working in their favor, as does Telecom and Discretionary. For a complete sector analysis, check out my latest post.

My Market Sentiment

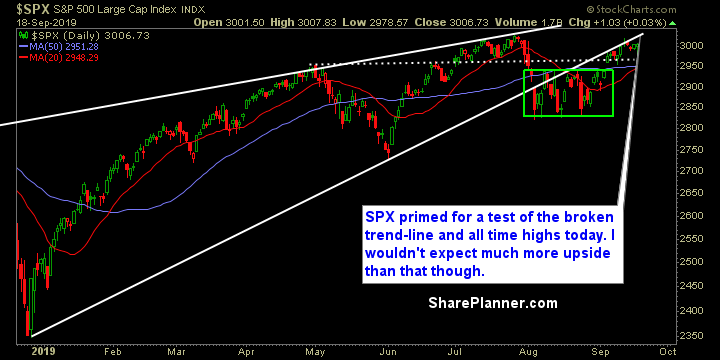

Testing the underside of the broken trend-line is possible today. I don’t have a lot of confidence beyond that for the price action. But a legit test should take us to new all-time highs. Overall, the consolidation over the last four days has been healthy for the market and should push prices higher from here.

Current Stock Trading Portfolio Balance

- 3 Long Positions