My Swing Trading Strategy

I was stopped out of my trade in Macy’s (M) for a loss yesterday, right at the open. I replaced the stock with a healthcare stock, and will hold off on making any additional trading decisions until after the FOMC Statement today.

Indicators

- Volatility Index (VIX) – A 1.5% decline, wiped out much of the prior day’s gains, and still has a gap left unfilled below. A strong potential for a big move today in either direction.

- T2108 (% of stocks trading above their 40-day moving average):A solid move has taken the T2108 to an incredible 72% reading. Not overbought necessarily, but much higher than what we have seen since March 4th.

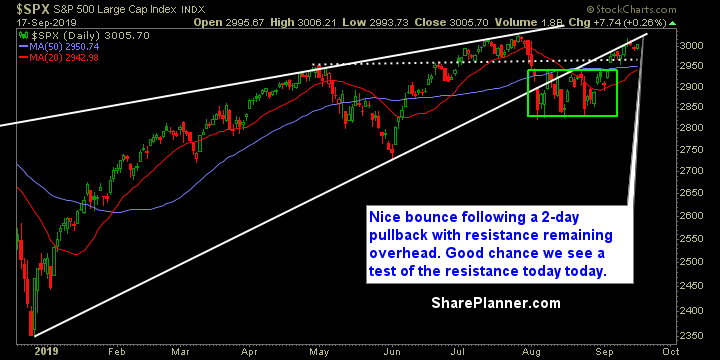

- Moving averages (SPX) Price reclaimed the 5-day moving average and now trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy was pummeled as I had previously mentioned was likely to happen in yesterday’s Trading Plan. Headline risk in this sector remains on the forefront. Utilities still showing itself as one of the most consistent and reliable sectors in the market as it posted new all-time highs yesterday. Real Estate continues to do the same. Yesterday’s rally saw a huge focus on safety stocks and this is likely due to the FOMC Statement expected out later today. For a complete sector analysis, check out my latest post.

My Market Sentiment

FOMC Statement comes out today at 2pm EST, followed by a 2:30pm presser. Jerome Powell typically creates all sorts of tension for the market at these events. Market expects a 25 basis point cut. Very easy that we see a move in either direction, but my guess is, that Powell, will do everything in his power to keep himself from having any kind of negative impact on the market.

Current Stock Trading Portfolio Balance

- 4 Long Positions