My Swing Trading Strategy

I didn’t add any new long positions to the portfolio yesterday as the market wasn’t showing quality breadth or conviction that would be enough to lead me to increasing my long exposure. Today may be more of the same, if the bulls come out trying to give up its early morning gains.

Indicators

- Volatility Index (VIX) – It’s the sixth time in the last seven trading sessions that there’s been a decline in the VIX. Currently sitting at 14, I still think it’ll see 12 in the near term before any substantial bounce is had.

- T2108 (% of stocks trading above their 40-day moving average): Snapped a six day winning streak with a slight decline. The indicator rests still at 68% which is a solid reading still and very bullish.

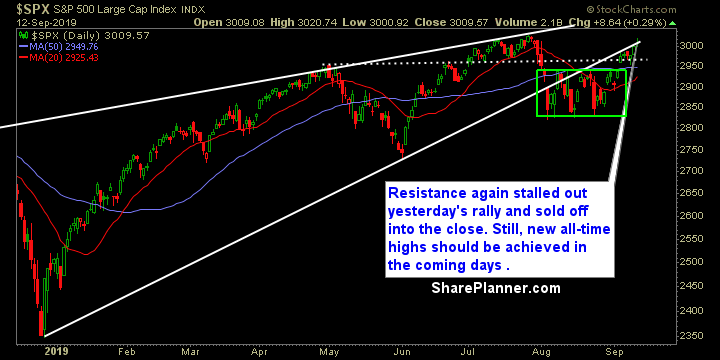

- Moving averages (SPX) Price is currently trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy slacked yet again yesterday. While it had its first red day is the last seven trading sessions, the previous two sessions were solid warning signs as each time it gave up the majority of its gains on the day. Financials continue to rally unabated, up ten of the last eleven trading sessions. Healthcare still acts like it can’t climb its way out of that August consolidation. A lot of your sectors in general have been on incredible runs of late, and may see some consolidation here in the coming days.

My Market Sentiment

Disappointing to see yesterday’s rally stall out again at the old trend-line resistance. Very close to new all-time highs, but unless it can break through that resistance level, it will continue to lack any real, notable upside momentum in the near-term.

Current Stock Trading Portfolio Balance

- 3 Long Positions