My Swing Trading Strategy

One new swing-trade was added yesterday to the portfolio, but didn’t increase my long exposure at all, as I was stopped out of one stock, and closed out another for performing so poorly. Neither loss was detrimental, but more about managing risk. I will look to add one additional long position today.

Indicators

- Volatility Index (VIX) – VIX was in a free-fall on Friday, dropping another 8% and closing at 15. Risk on mentality is permeating the market as VIX looks to make a move back towards the 11-12 area.

- T2108 (% of stocks trading above their 40-day moving average): Hardly any movement in the T2108, after giving up all of its gains Friday afternoon. However a very strong reading still.

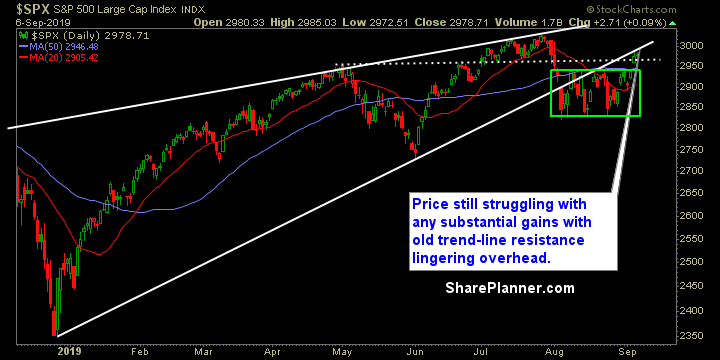

- Moving averages (SPX): Currently trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Telecom continues to run very hard and ready to break all-time highs that haven’t been seen since the year 2000! Staples are still in a similar rally mode right now as well. Energy showed itself again as an unreliable option going forward, while Technology also struggled though its chart still looks poised for a test of all-time highs. Healthcare looks like it has lost its way, as it continues to trade in a sideways range and an even bigger sideways trading range going back to February.

My Market Sentiment

Friday saw an afternoon sell-off, but showing resistance at the old broken trend-line. However, the box breakout did hold, and I still hold the expectation that price will re-test all-time highs.

Current Stock Trading Portfolio Balance

- 3 Long Positions