My Swing Trading Strategy

I booked profits in SPXU yesterday for a 2.4% gain, and SQ for a 0.6% profit. I’ll look to add one or two new trades to the portfolio today.

Indicators

- Volatility Index (VIX) – A very mellow 3.6% rise in the index on a day where the market was trying to sell off. The afternoon saw most of its gains evaporate.

- T2108 (% of stocks trading above their 40-day moving average): A 9% drop yesterday took the indicator back down to 35%. Really no direction being provided by this indicator.

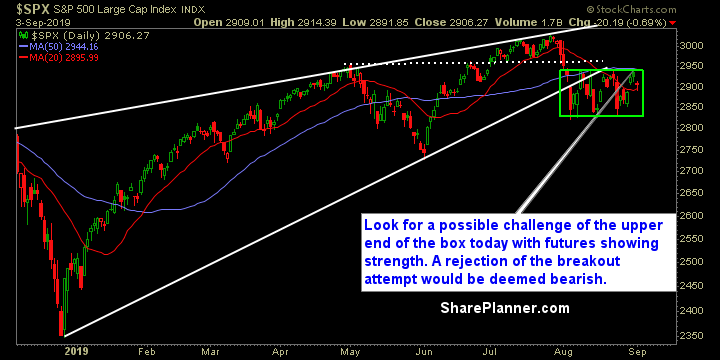

- Moving averages (SPX): Yesterday’s pullback did little in the way of technical damage as price managed to test and hold the 5, 10 and 20-day MA’s. A test of the 50-day should come today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities rose 1% yesterday and were the big market winners, along with other safety sectors like Staples and Real Estate. The market had a risk off mindset with Industrials, Technology and Discretionary leading the way lower.

My Market Sentiment

Today is a great opportunity for the market to breakout of this consolidation that it has been stuck in for the last four, now going on five weeks. If that happens, I expect that SPX will eventually test its all-time highs in the not so distant future.

Current Stock Trading Portfolio Balance

- 2 Long Positions