My Swing Trading Strategy

I’m under the threat of a hurricane today, so that makes trading a little dicey for me today. Power could go out, internet/cell coverage could go down. As a result, my focus today will likely be to manage the existing positions and nothing else.

Indicators

- Volatility Index (VIX) – A 6.2% pop yesterday and could move higher again today. Essentially a bull flag-like consolidation for the past month. The rise on Friday came despite a slightly positive trading day on SPX.

- T2108 (% of stocks trading above their 40-day moving average): A divergence from the VIX as T2108 saw a 2.4% rise, but still within its consolidation range of the past month.

- Moving averages (SPX): Unable to break above the 50-day moving average on Friday, and was quickly rejected just underneath the MA.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Friday’s rally struggled in part because Discretionary was the weakest of all the sectors. Energy lagged as well, and Technology couldn’t participate. Also saw some bidding up of Utilities and Telecom that should be concerning going forward.

My Market Sentiment

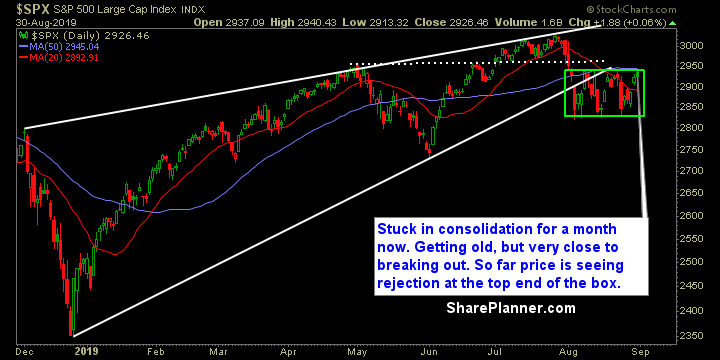

Consolidation remains, as we head into a new month of trading. The top end of the range is in play for a break out, and if that happens, I think we will see a slow crawl back to the all-time highs. That’s really the name of the game right now. Break out of or down below this consolidation box, and that will determine future price direction. Until then, price action is uncertain.

Current Stock Trading Portfolio Balance

- 3 Long Positions, 1 Short position.