My Swing Trading Strategy

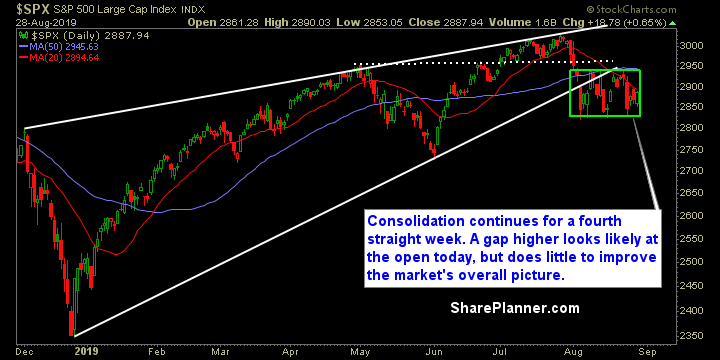

I’m likely to be forced out of my two short positions, while riding my one long position higher. I am open to add one to two new long positions, but until we break out of this four week consolidation pattern, I am not going to put a lot of confidence in these headline rallies.

Indicators

- Volatility Index (VIX) – A 4.7% drop yesterday, likely to see further weakness today with a major gap higher in the indices today.

- T2108 (% of stocks trading above their 40-day moving average): A 14% pop yesterday takes the reading back up to 33% but no improvement, in terms of breaking out of month long consolidation. May see a chance at that today.

- Moving averages (SPX): Broke through the 5-day moving average yesterday, and should see a gap above the 20-day MA today, which has been heavy resistance for SPX the past few weeks.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy was once again the big market winner while Materials were right behind. For today’s market bounce, I wouldn’t focus on either of those sectors, and instead focus on Technology and Discretionary, which should house the biggest moves in the market today.

My Market Sentiment

A possibility for the market to break out of consolidation if it can put together a rally in excess of 56 points on SPX. While that is probably unlikely, it isn’t impossible. Otherwise, price action remains contained and uncertain in terms of future direction. The bullish outlook though is being greatly diminished if today’s gap higher holds strong.

Current Stock Trading Portfolio Balance

- 1 Long Position, 2 Short Positions.