My Swing Trading Strategy

I added one additional short position yesterday to the portfolio, while keeping the existing portfolio and balance the same. I won’t look to add any additional short exposure here, until we get confirmation that the market wants to break down and out of the current trading range that price finds itself stuck in.

Indicators

- Volatility Index (VIX) – A 5% pop yesterday wasn’t anything impressive yesterday. Bull flag forming on the index,and could see a breakout here in the near future to the upside.

- T2108 (% of stocks trading above their 40-day moving average): A 10% decline yesterday wiped out the previous day’s gains. Yesterday’s move seemed quite significant considering how the market didn’t really decline that much and has a bear flag indicating further declines could be coming the stock market’s way.

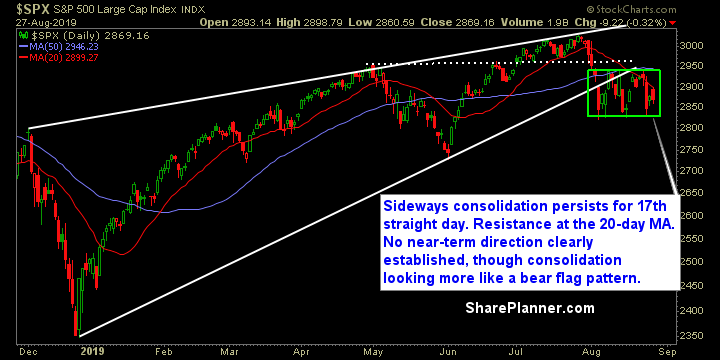

- Moving averages (SPX): Rejected perfectly at the 20-day moving average and proceeded to sell off hard and wipe out all of the gains the indices were experiencing.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

All sectors lost their gains yesterday and finished in the red, except for Materials, which finished the day flat.However, this sector concerns me just as much with a double top and bear flag starting to form. Utilities struggling with breaking out as two of the last three days have resulted in head fakes. Technology also sporting a double top, but no where near confirming the double top, but like all the other sectors,is showing a bear flag.

My Market Sentiment

Consolidation begins its 18th day, which has persisted for nearly all of August, and made for a difficult trading range for most investors and traders. On the whole, I have liked where my portfolio stands this far into the month. Watch for a break down and out of the box to get more bearish on this market. While a breakout to the upside is possible, price action has been more bearish up to this point and more likely we power lower from here, considering the bear flags popping up across the sectors and indices.

Current Stock Trading Portfolio Balance

- 1 Long Position, 2 Short Positions.