My Swing Trading Strategy

I closed out my position in QID for a +2% profit. Not thrilled about the ultimate outcome of that trade, especially considering how well the futs were performing Sunday night, but that is the stock market for you, what the current situation happens to be doesn’t denote its ultimate outcome. I added a new short position, while keeping my long position already in the portfolio to give it more of a neutral balance.

Indicators

- Volatility Index (VIX) – Considering the moves in this index of late, a 2.8% decline yesterday on a +30 point move, doesn’t match what I would have expected. Should see some further weakening today, initially at least, as futures are pointing to a higher open.

- T2108 (% of stocks trading above their 40-day moving average): A 10.4% move isn’t bad, but not phenomenal either. Breadth in the market was about 2:1 yesterday, which again isn’t euphoric or signaling a massive amount of bullishness attached to a 31 point rally.

- Moving averages (SPX): No changes on the moving averages, currently only trading above the 200-day MA and nothing else.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Discretionary and Technology was in the top three sectors yesterday which was a positive development yesterday. Again, if you are bullish on Energy, it should be concerning for you that, even though it finished in the green, it was the weakest of all the sectors. Materials has also been a very weak sector, especially after Friday’s sell-off, and I would stay away. Telecom was at the top of the list and very close to breaking out of a three week consolidation pattern.

My Market Sentiment

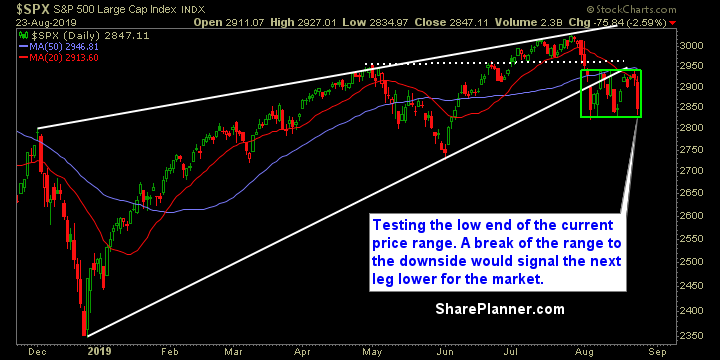

A bounce yesterday, but hardly one that showed much enthusiasm, and a market the resumed the pattern below average volume on the rallies. Much of yesterday’s rally came in the final 10 minutes of trading, and looks to push higher today, but until the range as shown below and now going on four weeks, is broken, these market movements cannot be shown any high level of trust.

Current Stock Trading Portfolio Balance

- 1 Long Position, 1 Short Position.