My Swing Trading Strategy

I added QID on Friday one the initial dump following Trump’s tweets. I held over the weekend, as well as my one long position too. Obviously futures are all over the place, and the only thing I can do here is tighten up my stops and see where price action wants to take us. I’ll consider adding either long or short positions today, but I won’t be aggressive in doing so, as that is a great way to get burned in these current market conditions. My sole short position is profitable, but will likely lose some of it at the open.

Indicators

- Volatility Index (VIX) – A big 19% spike on the VIX Friday, that is looking at a decline of more than 2% at the open today. VIX price action continues, like the broader market, to be contained within a three week chop range.

- T2108 (% of stocks trading above their 40-day moving average): A massive 26% decline on the indicator took the index down to 29% in the previous trading session. Overall stocks in general are very very bearish, and this indicator is signaling as much too.

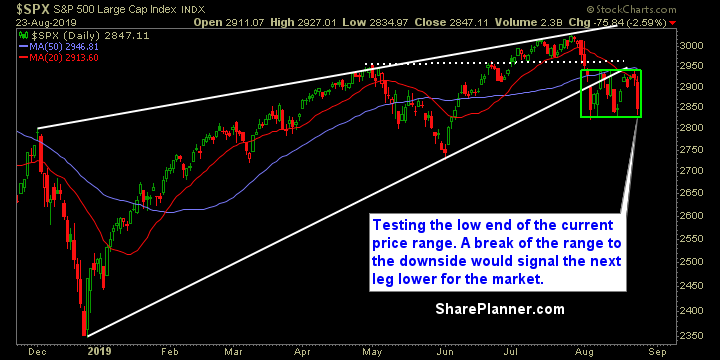

- Moving averages (SPX): Price broke and closed below the 5, 10 and 20-day moving averages, and though not discussed much, the 150-day MA as well, which had previously offered the market some support to work with.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

The sectors that you’d expect to be bearish on a day like Friday was indeed bearish. Energy simply can’t be traded with any confidence to the upside. This is by far the most bearish of all the sectors currently. Technology saw a massive selloff on Friday and while the futures are looking at a bounce in the early going, keep an eye on the August lows, as a break would signal the next big move lower. Discretionary getting dangerously close to confirming a textbook double top pattern as is Industrials. Financials continues to roll over, though all these sectors are likely to see some bounce at the open, it becomes more about whether the market can sustain these bounces.

My Market Sentiment

Sideways trading pattern looks to continue rather than breakdown at the open here with pre-market strength. As long a price range remains stuck in this three week chop-fest, there is little-to-no direction in the stock market. Expect plenty of more tweets and headlines in the week ahead to drive the market in both directions.

Current Stock Trading Portfolio Balance

- 1 Long Position, 1 Short Position.