My Swing Trading Strategy

I added one long position to the portfolio on Friday. Didn’t want to be too aggressive in that area, simply because of the huge and unpredictable gaps in both directions over the last two weeks. Today, we are gapping even higher, and will look to find one or two trades that can provide a solid reward/risk going forward.

Indicators

- Volatility Index (VIX) – A 12.8% decline yesterday, is likely to see another similar drop again today with market futures gapping up wildly. A break of 16.82 would signify a more bullish tone for the markets going forward and a likely retest of the all-time highs.

- T2108 (% of stocks trading above their 40-day moving average): A 20% rally on Friday, but on the whole, most stocks have not bounced significantly off of their recent lows. The current reading still sits at 33%

- Moving averages (SPX): Friday’s hard bounce resulted in capturing the 5 and 10-day moving averages again. Possible we could see a test of the 20-day moving average today as well, but will require a massive rally.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

See the full sector analysis I did by clicking here.

My Market Sentiment

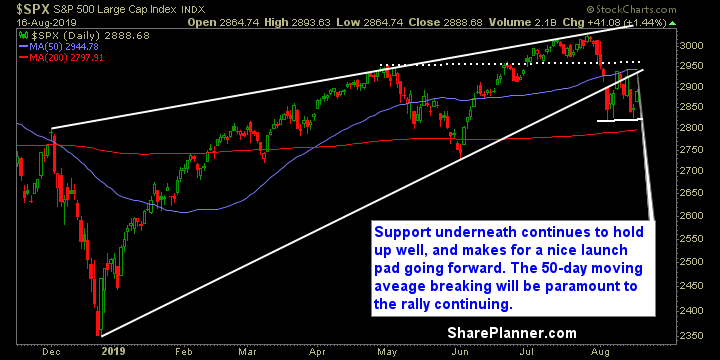

Looking a a third straight day of the market rallying. Looking for a test of the 50-day moving average in the days ahead to break the market out of the two week consolidation period. Headline risk of late has tilted toward the bulls, and the recycling of trade headlines has kept the bears from really bringing the market to its knees. The 2825 price level will be key for the bears if they want to eventually turn this market lower in the future again. Right now, that isn’t happening.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 Long Position.