My Swing Trading Strategy

I kept my positions the same heading into the weekend,and means I am still short on this market, and at the very least, the open,should be quite favorable today. I may consider adding more short exposure depending on the price action in the early going, and the overall breadth and volume connected with the sell-off.

Indicators

- Volatility Index (VIX) – Volatility h as been crushed over the last three days, going from almost 25, down to 16.91.

- T2108 (% of stocks trading above their 40-day moving average): An 11% decline on Friday, sets up for a potential reversal back into the 20’s, as its current reading is only sitting at 37%, and signaling an end to the dead cat bounce in equities.

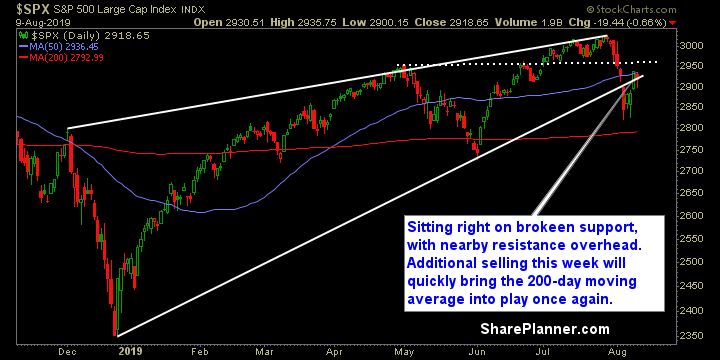

- Moving averages (SPX): Back below the 50-day moving average and unable to break through the 10-day moving average either. Both MA’s were perfectly tested on Friday and both rejected price.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Your growth sectors of Materials, Technology and Discretionary led the way lower on Friday, and while Tech is still managing to hold its rising uptrend off of the December lows, the other two sectors have not and have broken their trend-lines and aim to push lower. Utilities has re-emerged as the healthiest of all the sectors at this point and while Healthcare hung in their admirably on Friday, it is still stuck in the same sideways trading pattern going back to January.

My Market Sentiment

After watching Friday’s price action, there is still a clear ‘buy the dip’ mentality among traders in this market. There is a lot of headline risk as well, and that creates a lot of headline risk for traders and investors alike. The less you trade the better off you’ll be – pick and choose your moments, and stick to the trading plan that you have for each trade.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 short position.