My Swing Trading Strategy

Yesterday was a real clown act by the market. I originally closed out my position in SDS for a 0.6% profit, only to have jump right back in the trade later in the day following the Trump Tweet. Right now, I have one staple play and one short position.

Indicators

- Volatility Index (VIX) – Another massive move to the upside yesterday of 11%,m to 17.87, the highest such reading since June 3rd, when the market bottomed following the May sell-off.

- T2108 (% of stocks trading above their 40-day moving average): A very hard 19% sell-off yesterday, took the indicator down to 46%, and out of the month long consolidation range from July. The lowest closing since June 26th. Today’s gap down in equities, should push the indicator even lower today.

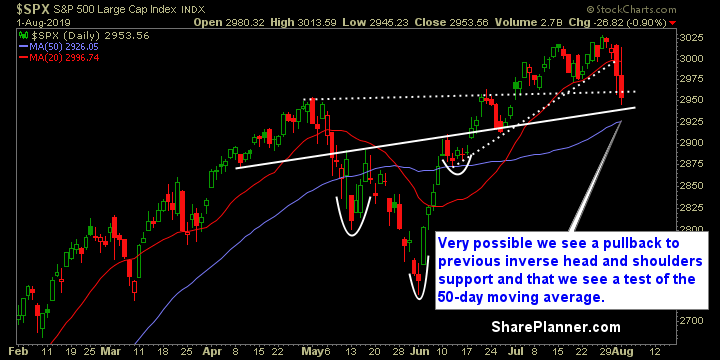

- Moving averages (SPX): Broke above the 5, 10 and 20-day MA’s but eventually dropped hard below all of them for a second straight day. The 50-day moving average will be in play today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

For a full sector analysis, check out my post here.

My Market Sentiment

SPX has broken below the previous break out level, and now looks to test the previous inverse head and shoulders neckline. Also the 50-day moving average should be considered in play too.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 long position, 1 short position.