My Swing Trading Strategy

I went more conservative yesterday, adding a utility play while also being stopped out of my software play. The market is showing a sketchiness towards growth plays this week, so far, and I’ll be looking to avoid such plays until the market can steady itself.

Indicators

- Volatility Index (VIX) – Downtrend in VIX since the May highs were established looks to break to the upside today with the morning weakness in equities. Look for a possible challenge of the July highs to establish new higher-highs for the first time since May decline started.

- T2108 (% of stocks trading above their 40-day moving average): A 4% decline yesterday, pushed the indicator down to 61%. The indicator sets up for more in declines, and remains as a bearish divergence as SPX was just hitting all-time highs on Friday, while the indicator remains below the high from earlier this month.

- Moving averages (SPX): SPX currently trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Even with Technology seeing immense weakness in software, it still could not beat the weakness in Energy as the latter managed to be the weakest sector yet again, with the Financials. Discretionary has managed to hold up quite well and in a good position to push through its May highs. But overall, capital was flowing into the safe sectors yesterday like Utilities and Real Estate as investors are getting nervous ahead of the FOMC Statement on Wednesday.

My Market Sentiment

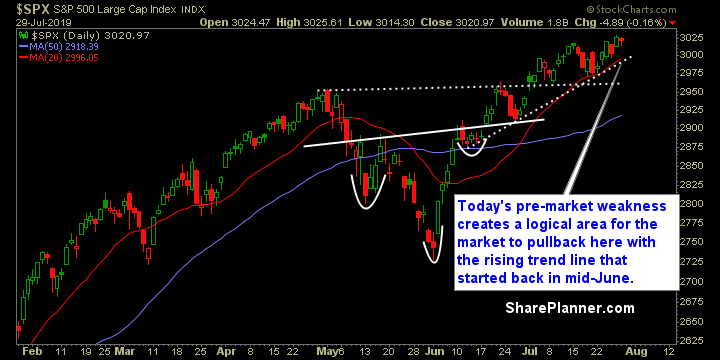

Short-term rising trend-line is in play today, and it is worth watching the 20-day moving average, as the last two times it has been tested, has resulted in a market bounce.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 long positions.