My Swing Trading Strategy

I added some financial exposure yesterday, and will consider adding more long exposure today, should the market conditions warrant it.

Indicators

- Volatility Index (VIX) – VIX sold for two straight days, and 6.8% yesterday alone, with the potential to see a retest of 12.00 in the very near future. However, with that said, VIX is approaching the area, that of late, has resulted in hard bounces higher.

- T2108 (% of stocks trading above their 40-day moving average): A huge 12% move yesterday, took the indicator back to 62% in total. Solid bounce for the indicator as a whole.

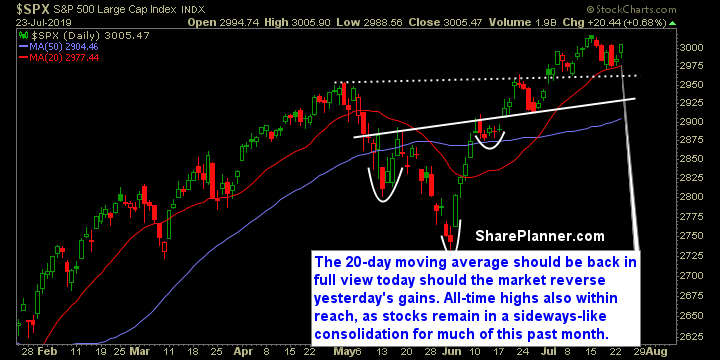

- Moving averages (SPX): The 5-day moving average crossed below the 10-day moving average while price is currently trading back above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Real Estate rallied hard yesterday on the news from Amazon (AMZN) getting involved with Realogy Holdings (RLGY). Industrials was a major player yesterday in the market rally. However, Catepillar (CAT) earnings will weight heavily on this sector today. Positive earnings from UPS (UPS) could counter such weakness. Discretionary showed signs of life once again following a four-day pullback. Financials are bouncing off of their 20-day moving average and looking to make a move back to recent highs. Technology looking very strong and ready to test all-time highs once again.

My Market Sentiment

Yesterday’s rally was very solid and with respectable breadth. However, with news weighing hard on FANG stocks following the start of an Antitrust investigation, there is a good chance that we see stocks struggle as a result, and potentially even give up much of yesterday’s gains.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 Long positions.