My Swing Trading Strategy

I closed out one of my trades yesterday that simply wasn’t doing anything for me and was simply wavering far too much due to the low volume, summer trading. However, I added one additional trade to the portfolio and looking to ride my two positions that I currently have, to higher prices.

Indicators

- Volatility Index (VIX) – Volatility getting smacked around once again. Dropping 6.3% and back below the declining trend-line off of the May highs. So far, Friday’s break out has been a head fake.

- T2108 (% of stocks trading above their 40-day moving average): Despite the market rally yesterday, the market saw very poor breadth, and it was reflected in the T2108, with a 5% decline down to 55%. At a point now, where it is ready to bounce.

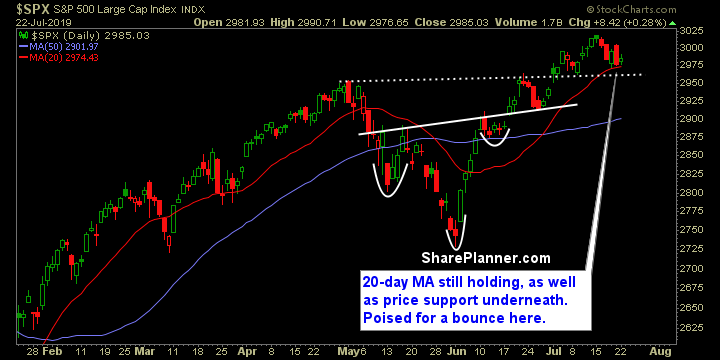

- Moving averages (SPX): Held the 20-day moving average for a third straight day, but still at risk of breaking. Still below the 5 and 10-day moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was the sector to be in yesterday, followed by, surprisingly, Energy. Telecom and Staples were the market’s big losers on the day. Safety sectors, on the whole, are still being sold.

My Market Sentiment

The 20-day moving average held, though breadth was very poor for yesterday’s market rally. Small caps simply struggling and not wanting to participate. However, Large caps holding up much better.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 Long positions.