My Swing Trading Strategy

I was stopped out of my Disney (DIS) trade yesterday, primarily due to the heavy influence from the Netflix (NFLX) earnings miss. However, I added two additional trades following the stop-out, and will consider adding a third position if the early morning strength can hold.

Indicators

- Volatility Index (VIX) – Hit the declining trend-line off of the May highs, and like clock work, immediately sold off, and finished 3.2% lower on the day.

- T2108 (% of stocks trading above their 40-day moving average): Finished a fractional amount lower, but held the 20-day MA, and shows signs that it may finally be ready to bounce back up towards the upper-60’s again. Currently sitting at 62%.

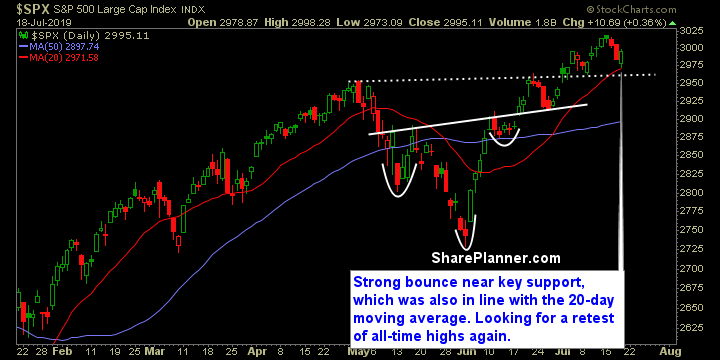

- Moving averages (SPX): Finished, literally, right on the 10-day moving average, while bouncing nicely off of the 20-day MA.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Even though the market had a solid bounce yesterday, it was all about the defensive stocks – Staples and Utilities – that led the way higher for the market. However, It found some help from Financials as well, but I have not at all been impressed by the setups in that sector just yet.

My Market Sentiment

Strong bounce off of the 20-day moving average yesterday, and never saw a true test of the 2957 support level that I had talked about previously. Now it looks like the bulls are ready to push it back to all-time highs again, especially if the morning strength can hold throughout the day. Discretionary lagged all the sectors, finishing in the red.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 Long position.