My Swing Trading Strategy

Closed out two trades yesterday, but managed to keep and raise the stops on three other positions. I’ll look to add 1-2 new trades to the portfolio today if the market decides to bounce. Momentum plays took a hit yesterday, so there’ll be plenty of them ready to bounce today.

Indicators

- Volatility Index (VIX) – A very minimal bounce yesterday for the VIX, only rising 1.4%. More of a 4-day consolidation pattern of late.

- T2108 (% of stocks trading above their 40-day moving average): SPX dropped over 10 points yesterday, which may not seem like much, but it is, compared to the recent sell-offs we have seen. However, the T2108, managed to crack a fractional gain on the day, and to stay at 67%, which it has been in a consolidation pattern for more than two weeks now.

- Moving averages (SPX): Lost the 5-day moving average but still trading above all the other major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

You would have thought there would have been a flight to safety, but Utilities, Telecom, Staples and Real Estate were no where to be found among the day’s top three sectors. Instead you have Industrials hitting new all-time highs yesterday and working on their seventh straight week of gains. Healthcare and Energy remain the market’s most problematic sectors and should be avoided going forward.

My Market Sentiment

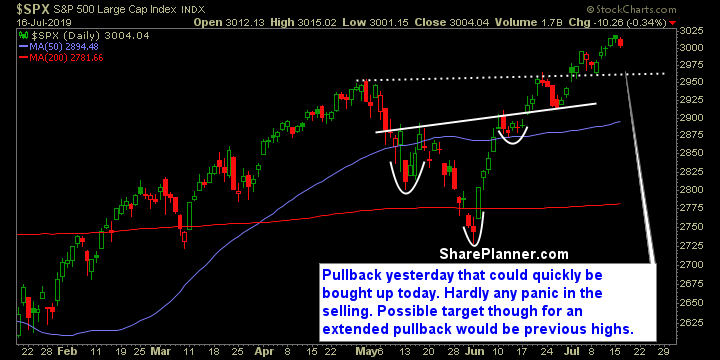

One of the bigger pullbacks we have seen since late June. Technically there wasn’t any damage done to the daily chart, so no reason to get bearish at this juncture or even begin to. The bulls are still in control, and the light volume still suggests a churning price action with a slight upward bias.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long