My Swing Trading Strategy

I took profits in Facebook (FB) on Friday for a +3% profit. I also added one other position too. I’ll be more inclined to let my current positions go to work for me this morning, and not over-extend my long exposure.

Indicators

- Volatility Index (VIX) – VIX dropped hard for a third straight day, dropping another 4.2% to 12.39. We are hitting some very extreme levels that usually result in a bounce in the index.

- T2108 (% of stocks trading above their 40-day moving average): A 2.7% decline yesterday and it remains in the consolidation range of the past two weeks at 65%

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

I’ve put together a full sector analysis report that you can access by clicking here.

My Market Sentiment

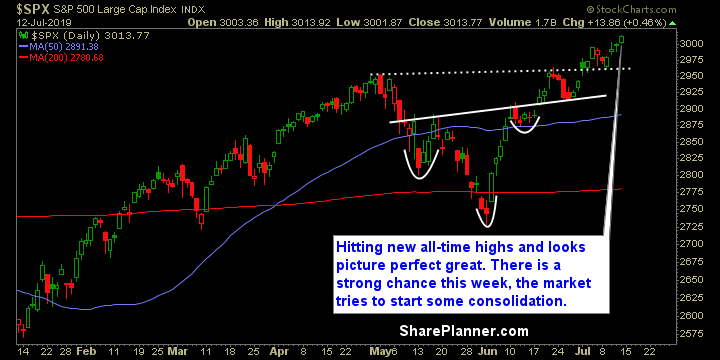

SPX hitting new all-time highs and pushing well through the 3000 level finally. Good chance we see some summer consolidation with low volume at this point, especially with volatility hitting extremely low levels again. The key is to not give up last week’s gains.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 50% Long