My Swing Trading Strategy

I added one additional trade. I am holding gains in Facebook (FB) coming into today, but following Trump’s comments, may be worth it to just book the gains and move on from that trade, considering the headline risk associated with the Libra currency of late. I also plan to increase my stop-loss in my other positions where appropriate, and even consider adding a new long position.

Indicators

- Volatility Index (VIX) – Not a lot of movement out of $VIX today, as it only dropped 0.8% yesterday forming a nice doji candle pattern. The 11-12 area on the VIX continues to be, over the past year, where the indicator bounces, and ultimately leads to some market weakness going forward.

- T2108 (% of stocks trading above their 40-day moving average): A 2.7% decline yesterday and it remains in the consolidation range of the past two weeks at 65%

- Moving averages (SPX): Tested and bounced off of the 5-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

I’ve put together a full sector analysis report that you can access by clicking here.

My Market Sentiment

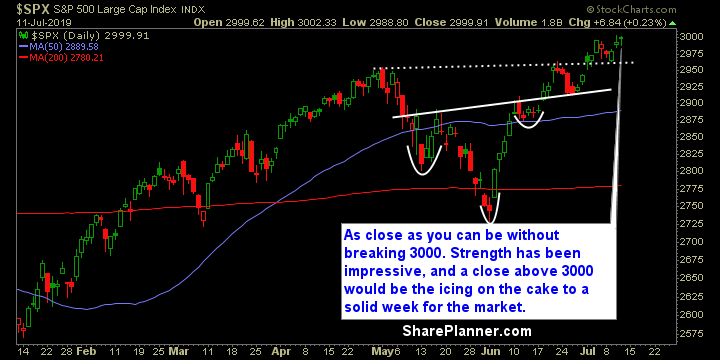

SPX managed to close 0.09 points below the 3000 milestone. Really it isn’t a big deal from a technical analysis standpoint, but these round number milestones tend to have some psychological effects on traders, as people will use them to book profits before, and to jump in after, once broken, due to the fear of missing out.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 50% Long