My Swing Trading Strategy

I added one additional trade yesterday, and will consider adding more today if the pre-market strength, following Jerome Powell’s comments holds up. I’ll also increase my stops on my current trades as well.

Indicators

- Volatility Index (VIX) – Rallied for the third straight day, despite the market finishing slightly in the green. Good chance we see a bigger move today with Powell testifying before Congress today.

- T2108 (% of stocks trading above their 40-day moving average): A 1% decline yesterday which is really no biggy. Still above 65% and sets up to take the indicator back up to 70% and possibly higher.

- Moving averages (SPX): Tested the underside of the 5-day moving average but was not able to break through. Should see a test of it again this morning.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology led the way higher yesterday while almost doubling the gains of the next closest sector (Real Estate). The sector is set up to break its highs from last week. Healthcare continues to establish higher-highs and higher-lows, and makes for fine dip buying plays. Yesterday it appeared that the bulls put a halt to the two day slide in that sector. Financials remain pretty strong and a lot of really fine trading setups out there in that sector. If the early morning gains holds, I would avoid defensive sectors such as Utilities, Real Estate and Staples.

My Market Sentiment

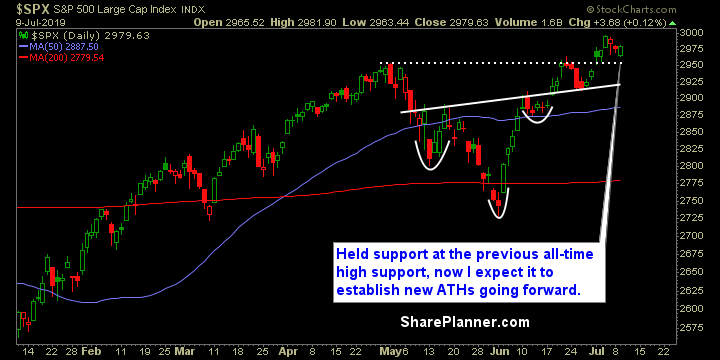

Beautiful pullback and bounce off of the previous support level at the all-times and a bull flag pattern along the way. Jerome Powell’s testimony should take price back near the all-time highs, unless in the questioning he drops a grenade on what he has already offered in his prepared remarks.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 40% Long