My Swing Trading Strategy

I closed out four positions yesterday: Best Buy (BBY) for a 4.6% profit, Take Two (TTWO) for a 2.1% profit, Netflix (NFLX) for a 1.8% profit, and Lyft (LYFT) fora 1.7% profit. I also added one additional trade to the portfolio as well.

Indicators

- Volatility Index (VIX) – VIX saw its lowest closing since early May, at 14.06, following yesterday’s huge market rally. A push into the 12’s or 13’s here is very possible, as the holiday week, will see less and less volume.

- T2108 (% of stocks trading above their 40-day moving average): Only a 3% rally yesterday which is much less than what I would have expected out of such a market rally, but the breadth overall in the market was not all that strong.

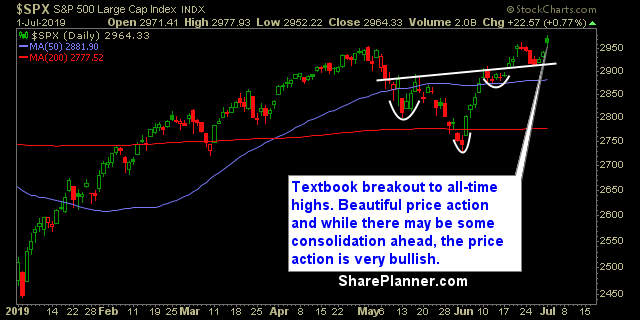

- Moving averages (SPX): Trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology, as expected, was the big market winner, with semiconductors doing much of the leg work. Financials made a big move pushing above key resistance. Discretionary confirmed a head and shoulders pattern to the upside. Energy looks like it could fade here.

My Market Sentiment

The daily chart looks pretty solid as new all-time highs were established yesterday for SPX. However, there is still an unfilled gap underneath that remains unfilled. Also of concern is the intraday fading that hits pre-market strength each and every day.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 10% Long