My Swing Trading Strategy

One additional trade was added yesterday, and while the futures are pointing higher, this morning, the ideal time to add another trade to the portfolio may be after the morning gap has been filled, as opening price levels have not been able to hang on as of late.

Indicators

- Volatility Index (VIX) – The declining trend-line from the 5/9 highs was tested yet again, but could not break through. May find itself in play once again today. But still the downtrend remains in place, and I expect to ultimately push lower.

- T2108 (% of stocks trading above their 40-day moving average): Fourth straight day of declines, this time of 3%, taking the indicator back to 45%. Only five days ago it was trading at 59%. However, the indicator doesn’t suggest that stocks are panicking or selling off hard.

- Moving averages (SPX): Broke below the 10-day moving average yesterday.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities saw one of its biggest sell-offs of the year yesterday , taking it below the 20-day moving average. The targeted area to buy stocks in this sector has been the 50-day MA which should be watched closely today. Likewise, Real Estate was hammered as well, taking it back to its year long support level. Energy is an interesting one to watch as it continues to coil over the last five trading sessions, and could see a break higher from here. Recovery in Technology yesterday, and remains in somewhat of a bull flag pattern. Materials coiling in a tight trading pattern over the last five trading sessions and could be setting up for a bigger move higher.

My Market Sentiment

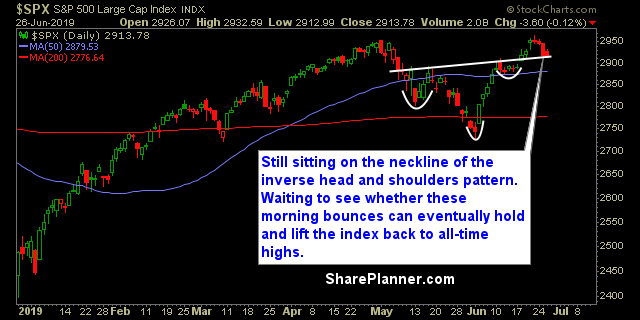

Inverse head and shoulders pattern still holding up, however price closed right on the neckline, again, yesterday for SPX, and will need to bounce hard today, if the pattern is to remain valid going forward.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 40% Long