My Swing Trading Strategy

I added one additional long position on the dip yesterday which is off to a good start so far. I’m a little concerned by the extent of yesterday’s pullback and the fact that volume came in to support the selling late yesterday. I’ll hold off on adding any new positions in the early going until we can see that the strength in the pre-market wants to hold.

Indicators

- Volatility Index (VIX) – A 6.7% pop yesterday that challenged the downward trend-line off of the May highs, but wasn’t able to break through it. Could be a fading spot here for the index.

- T2108 (% of stocks trading above their 40-day moving average): Despite a 28 point decline on SPX yesterday, T2108 was only down 4%. The small caps weathered the storm much better than large caps, and kept breadth on NYSE from ever eclipsing 2000.

- Moving averages (SPX): Broke right through the 5-day moving average but managed to test and hold the 10-day MA and hold.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

All the sectors finished in the red yesterday with Staples weathering the storm the best. Technology was really the major drag on the market, down nearly 2% and taking on some significant damage on its daily chart. Energy trading back into its gap from last week. Industrials pullback looks slow and steady and without any real panic.

My Market Sentiment

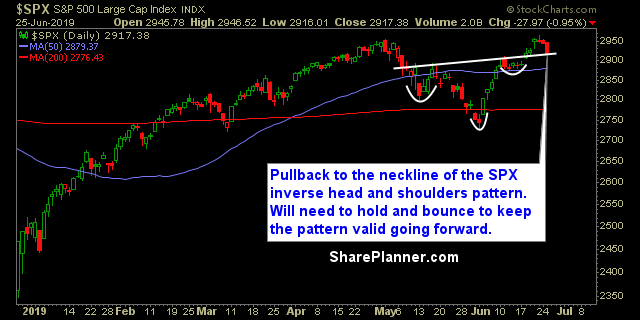

Inverse head and shoulders pattern still holding up, however price closed right on the neckline yesterday for SPX, and will need to bounce hard today, if the pattern is to remain valid going forward.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long