My Swing Trading Strategy

Currently holding on to two positions in the portfolio, and with the lowest volume seen in over a year in the market yesterday, I refrained from adding any new positions. I’ll look to add additional long exposure today, should the market show the desire to push higher.

Indicators

- Volatility Index (VIX) – Small drop of less than 1% and unable to break back above the 50-day moving average. Setting up for further downside this week.

- T2108 (% of stocks trading above their 40-day moving average): Another large decline of 8.5% yesterday, taking the indicator back below 50%. Just two days prior it was sitting at 59%. Small caps are largely to blame for this, as they have been much weaker in recent days.

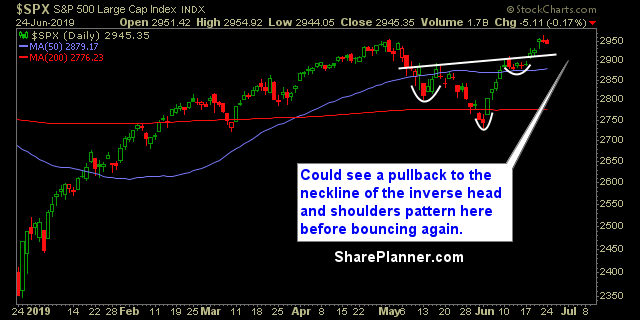

- Moving averages (SPX): Currently trading above all of its major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Healthcare saw the most weakness yesterday, as the biotechs were clobbered. Materials, on the other hand, managed to keep its upward momentum in place, as the only sector to finish in the green yesterday. Financials have pulled back for a second straight day, and could be a dip buy opportunity as it tests the rising trend-line off of the June lows. The same can also be said of Technology.

My Market Sentiment

Inverse head and shoulders pattern still intact despite two days of selling. Could see a pullback to the neckline before bouncing again. Also, the two days has formed the beginning of a bull flag pattern, which would be healthy for the market.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long